Mainstream publications commonly tout Bitcoin as a speculative asset that gives the general public access to the type of trading platform that typically only accredited investors have access to.

While even Elon Musk has taken an exuberant dive into Bitcoin investment, the excitement over buying and holding digital assets with an intent to sell at a higher price later (often referred to as “hodling”) indicates a poor understanding of Bitcoin’s underlying technology.

Before you take the plunge and start learning about Bitcoin, on your own or via a Bitcoin training course, take heed of these often misunderstood facts about Bitcoin.

1. Bitcoin Core (BTC) is NOT the Bitcoin of the white paper

We start by taking on one of the biggest mainstream (mis)understandings of Bitcoin: that BTC represents Bitcoin as described in Satoshi Nakamoto’s white paper. Here are some of the most profound differences between BTC and the protocol described in the white paper:

- The white paper describes a highly scalable micropayments network that allows for transactions to be processed quickly for a fraction of a cent. Both the fee structure and congestion of the BTC network make it incompatible with this vision.

- In section 2 of the white paper, an electronic coin is defined as a chain of digital signatures. With the implementation of SegWit, BTC stripped the signatures away from much of the chain.

- According to section 12 of the white paper, miners (‘nodes’) enforce the network’s rules and incentives, they do not get to change it. In the BTC network, miners and developers use forks to introduce changes to the network protocol. As a result, each new version of the BTC protocol has strayed further away from the original Bitcoin described in the white paper.

A dire consequence of this ‘chop-and-change’ mentality is that applications risk becoming incompatible with the network according to each developer’s whims. The same goes for individual smart contracts that were set to initiate at a future time. No stable protocol means no assurance of compatibility in future. Imagine programming a time-locked transaction, but by the time it should execute, changes in network rules have made the transaction impossible – effectively burning the coins!

2. Bitcoin is the fusion of data (Bit) with money (Coin)

Bitcoin’s monetary token is perhaps its best-known feature. What is not commonly understood is where it fits in within the larger network. While the token is an essential part of the network, it is not created for its own sake.

Bitcoin fuses monetary value with data, and in doing so it enables a set of features that are lacking in all other data and financial management systems.

The benefits of Bitcoin’s fusion of data and money include the following:

- The monetisation of the Internet through microtransactions. By fusing money with data, Bitcoin lets us attribute value to individual data points while offering a channel through which we can trade that value. This ‘monetisation of the Internet’ creates a huge opportunity to improve existing ecommerce systems and invent entirely new online business models.

- In a corporate scenario, the fusion of data and money also makes way for improvement and innovation. Businesses can set complex criteria for collecting and trading data and automate this process via the blockchain.

For example, a medical research company could canvas for participants in a study. Individuals who choose to participate are asked to submit their existing medical records to the blockchain, under the condition that it can only be accessed by this particular medical company. To incentivise mass participation, the company could offer remuneration per data point. Whether someone contributes a single record or a lifetime’s worth, they will automatically be paid upon submission.

Read the ‘What is Bitcoin?’ eBook to learn more.

3. Bitcoin walks the tightrope between privacy and traceability

There is great confusion about the privacy versus transparency of data on the Bitcoin public ledger.

Bitcoin makes use of pseudonymous identifiers, which already provide an element of privacy.

In addition, zk-SNARKS (Zero-Knowledge Succinct Non-Interactive Arguments of Knowledge) and other industry recognised encryption techniques can be used to encrypt data payloads within a Bitcoin transaction itself.

The combination of encryption plus obfuscation makes it possible to store even the most sensitive data, such as medical records, on the blockchain’s public record while maintaining compliance with data protection regulations.

The benefits of Bitcoin’s balance between privacy and traceability include the following:

- Companies and individuals can secure sensitive data while making accessible what is in the public’s interest.

- Given the permanent record of data interactions, a business can review its operations from beginning to end to get a clear picture of inefficiencies and opportunities.

- If regulators should question your auditor’s report, they can query the Bitcoin ledger to verify the underlying data’s accuracy. Though you would have to reveal your Bitcoin address to the authority in question, your financial and other sensitive data will stay out of the public eye.

4. Bitcoin is about technological revolution, not speculation

When Satoshi Nakamoto created the Bitcoin blockchain in 2009, he envisioned that it would be rolled out as a global data management system that would scale to serve an unlimited number of data applications – citing the ability to make tokens and even bootstrapping a pay-to-send-email on-chain.

By returning to Bitcoin’s original design, the BSV blockchain (Satoshi’s Vision) blockchain project is on track to deliver the protocol and infrastructure necessary for the fourth industrial revolution. Inherent to this system are the qualities of stability, security, scale and sophistication that a data-based economy demands.

Read the ‘What BSV blockchain is and why it’s the blockchain for the data economy’ eBook to learn more.

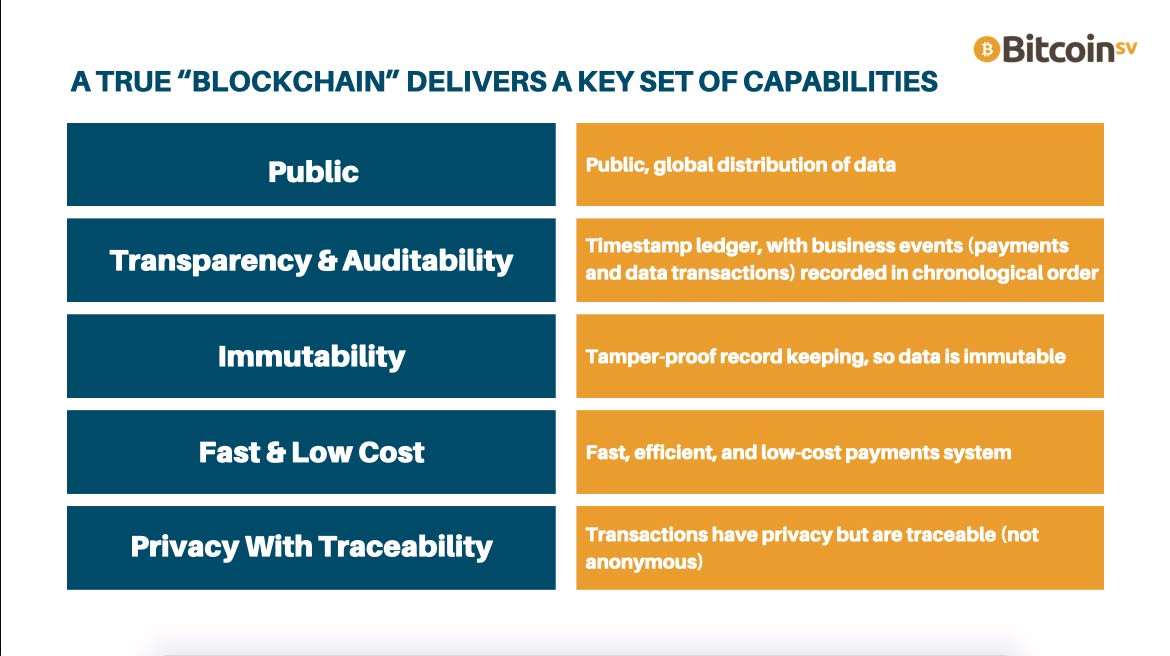

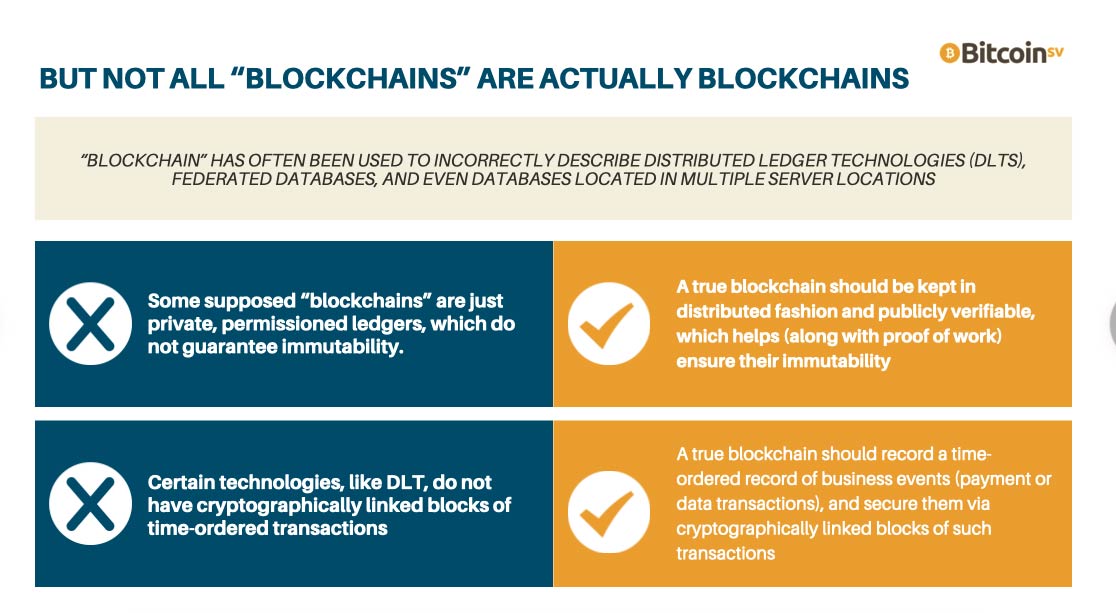

5. Bitcoin is the model for blockchain technology

The blockchain model is derived from the invention of Bitcoin. We can consider the Bitcoin blockchain the archetype or model for blockchain systems. The characteristics of this model are described in the Bitcoin white paper.

This blockchain model can only achieve the greatest efficiency by operating as the sole data management system to serve billions of applications globally. In such a scenario, interoperability between all parts of business and society is maximal, while infrastructure costs are kept to a minimum as the network replaces all other data management systems.

Though there are blockchain projects that follow different variations of the model, they will not deliver the same efficiencies. As ‘blockchain’ is commonly used as a buzzword, it is worth taking any project using that label with a grain of salt.

Read the ‘What is Blockchain?’ eBook to learn more.

Bitcoin courses to ramp up your knowledge

Bitcoin Association, the Switzerland-based global industry organisation that works to advance business with the BSV blockchain, has launched BSV blockchain Academy – a dedicated online Bitcoin education platform which offers academia-quality, university-style courses and learning materials.

Courses are divided into three streams:

Within each stream, courses are offered at introductory, intermediate and advanced levels. At the conclusion of each course, participants will undertake an online assessment to test their understanding of the material, with certifications awarded to those who pass.

Ready to get Bitcoin-certified?

BSV blockchain Academy programmes allow you to adapt the curriculum to your life. You can learn at any time convenient for you. They are self-paced, so you can go as fast as you want or as slow as you need. The Academy’s engaging platform creates an exciting and connected experience wherever you are in the world.

If you are ready to learn about the design of Bitcoin and how economic incentives drive the development of the network, register a free account now.