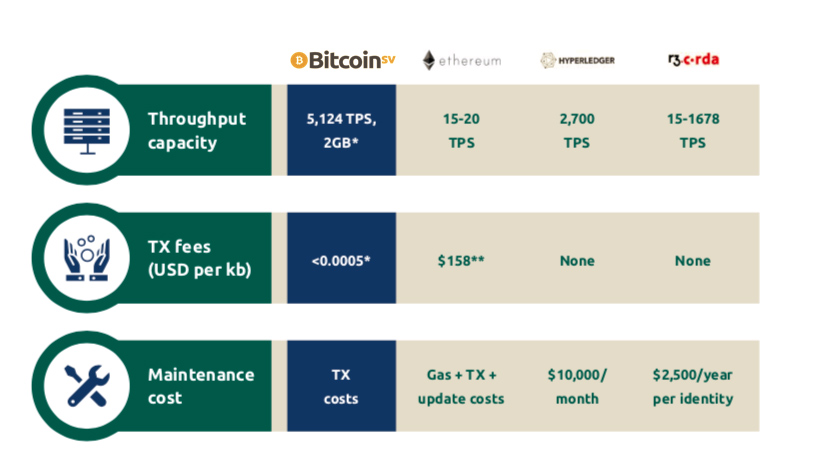

Perhaps you own some cryptocurrency such as Ethereum and have found it stuck in your wallet or exchange due to network congestion and extremely high transaction fees. The coins you own are all but useless and become a reminder of a bad investment.

Apart from the short-term pain to your pocket, blockchains with absurd fee models will continue to struggle to find adoption outside of speculation markets, with Bitcoin node implementations facing a Chain Death scenario as the reward subsidy decreases.

*Median over 90-day period, 12-1-2021 to 11-02-2022, source: https://bsvdata.com/blockchain

**Ethereum’s Yellow Paper states that it costs 20 000 gas to store one 256-bit word.

8 bit = 1 byte, therefore 256-bit word = 32 bytes.

1024 bytes = 1 kilobyte, therefore 1 kilobyte costs 32 x 20,000 gas = 640,000 gas.

Median gas price = 50 Gwei x 640,000 = 32,000,000 Gwei (11-02-2022) = 0.0512 Eth

Converted to USD = $158,77 (11-02-2022)

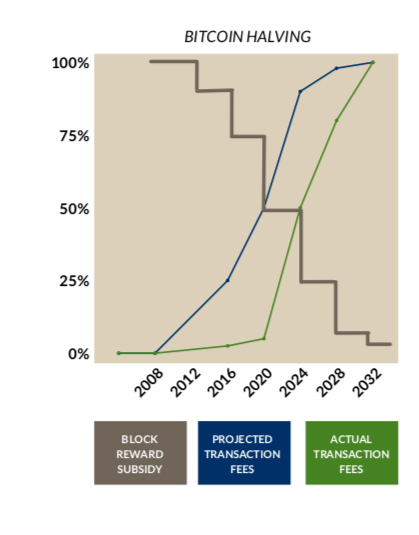

Bitcoin’s incentive scheme

On Bitcoin, the block subsidy rewards are cut in half after every 210,000 blocks are mined. Satoshi’s goal was to incentivise miners to invest into the network with proof-of-work. As the network matures and scales, transaction fees would replace the subsidy reward.

Bitcoin’s incentive scheme gets broken

Unfortunately, after Satoshi, BTC core developers and blockchain experts never really understood the original Bitcoin protocol’s design and stagnated scaling.

‘Bitcoin can already scale much larger than [Visa] with existing hardware for a fraction of the cost. It never really hits a scale ceiling.’ – Satoshi Nakamoto, 2009, The creator of Bitcoin

The arbitrary 1mb block size limit on BTC prevents the chain’s ability to scale and provide global utility, (7 transactions per second) forcing the gross-use of energy to capitalise on speculative rewards. It’s purely an economic decision by miners and one that won’t last forever.

The capped block size limits how many transactions can be included. Fees become volatile and the network unusable. Over time, fees must rise to replace the lost revenue in the miner block subsidy or chain death occurs.

Bitcoin halving event and chain death scenario

A chain death is a scenario where the revenue of the block reward does not justify a transaction processor’s cost of finding one. This scenario becomes a threat if the transaction fees do not offset the lost revenue from the dwindling subsidy. Processors will no longer support the network, potentially bringing the chain to a halt as no more blocks will be added.

Bitcoin Core (BTC) blocks are limited to 1mb in size, occurring on average every 10 minutes. The capped block size limits how many transactions can be included. Fees become volatile and the network unusable. Over time, fees will rise to replace the lost revenue in the miner block subsidy.

Bitcoin Satoshi Vision (BSV) Blocks are unbounded in size, occurring on average every 10 minutes. With uncapped blocks, transaction fees remain stable and low. Over-time, reward subsidy is eclipsed by transaction fees.

Back to the original Bitcoin protocol

Restoring the original Bitcoin protocol by removing the real centralisation bottleneck, has allowed true innovation and unbounded on-chain scaling to occur.

On August 16, 2021, at 15:20:11 (UTC), block number 700606 was mined, containing 1,999,941,397 bytes of data (2 GB).

The record-breaking block gave the BSV blockchain miner a profit of 10 BSV coins in transaction fees in addition to the fixed block subsidy of 6.25 coins. The revenue from transaction fees alone is 160% more than the fixed subsidy.

Furthermore, CO2 emissions have always been correlated with mining revenues and not the number of transactions. Since mining is what consumes energy, and blocks are the product of mining: the more transactions in a block, the lower the energy consumption and carbon footprint per transaction.