The potential applications of blockchain technology and the Bitcoin protocol have been the subject of much speculation, the intensity of which has been excited by a global fervour surrounding the price of digital tokens. The utility of a blockchain is, however, separate from the speculative price of its digital token.

The original Bitcoin protocol was designed to create a network that enabled true peer-to-peer digital cash, complete with data management and processing, using a distributed timestamped ledger called the blockchain. The success of this blockchain protocol therefore stems entirely from its utility and ability to meet these goals and enable this next generation of accessible applications – not from the price its digital tokens trade for on online marketplaces.

BSV is the blockchain network most aligned with the original vision of Bitcoin as outlined in Satoshi Nakamoto’s original 2008 white paper, offering fast, low-cost transactions and a network that scales unbounded. The BSV blockchain has been shown to support transaction volumes greater than those of traditional digital payment networks such as VISA, and its scalability means it can improve this throughput to a practically limitless degree.

The BSV network can deliver this scalability and utility thanks to its removal of a temporary and artificial block size limit imposed on the Bitcoin protocol by early Bitcoin Core (BTC) developers, who altered the vision of the network to align with a ‘store-of-value’ or ‘digital gold’ narrative. By removing this block size limit and restoring the full functionality of the Turing-complete and fully-fledged Bitcoin Script scripting language, the BSV blockchain can deliver the endless utility of smart contracts, as well as ultra-low-cost transactions that are processed quickly and reliably.

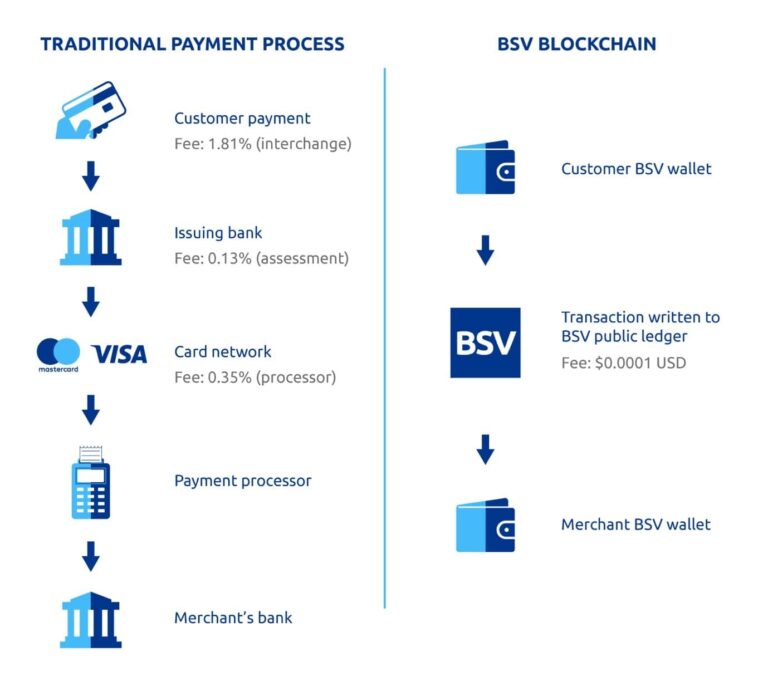

The potential applications of the BSV blockchain are myriad – from empowering merchants with the ability to participate in a competitive market for their transaction processing to offering enterprises a utility blockchain for large-scale data management and process automation. The most immediately apparent use case for the BSV blockchain, however, is nanopayments. Nanopayments are payments comprising an extremely small sum, often made in high frequency to nano- or micro-service providers. Nanopayment business models are not viable within the traditional digital economy due to the high minimum fees charged by payment processors, banks and other intermediaries. However, through BSV, a new world of nanopayment business use cases has been opened.

Nanopayments and the BSV blockchain

The crucial component of the BSV blockchain that makes nanopayments viable on the network is its low transaction fees and unbounded block size. Compared with other blockchain protocols, it is far more capable of scaling to the demands of the nano-service enterprises of the future.

‘There are many things you can do with BSV, but I think that nanopayments are the simplest and easiest to understand. We are also already seeing the potential behind it with new companies creating new business models,’ explains HandCash co-founder and CTO Rafael Jimenez Seibane.

‘You just have to compare the fees with other networks, and I think it’s very clear and very easy to realise that [their fees] are not sustainable. I’m not even talking about BTC fees, but even with Ethereum, they make no sense. Right now, what works and has been working already for a few years is BSV.’

HandCash is a popular BSV wallet that offers simple and fast peer-to-peer payments paired with a range of powerful functionalities. The wallet service provider has also launched HandCash Connect – an SDK allowing companies to integrate BSV payments easily and rapidly into their web portal, application or software ecosystem. HandCash is aimed squarely at the development of payment infrastructure that enables nanopayment business use cases on the BSV blockchain, and the team is confident that fees will remain stable and low to enable this.

Thanks to its unbounded block sizes, the BSV network is capable of handling unprecedented transaction volumes while keeping fees low for individual transactions. The original Bitcoin protocol on which the BSV blockchain runs is designed according to a UTXO (unspent transaction output) model. This means transactions function similarly to real cash, where users hold unspent outputs comprising satoshi tokens with discrete transaction histories. These can be merged and split to tiny denominations far beyond those of conventional notes and coins, and the change from any transaction is calculated and returned to the spender as part of the payment process, minus a transaction fee paid to the miner of the block which includes the transaction.

As the network scales in adoption and transaction volume, transaction fees become increasingly important to miners as their primary source of income from mining blocks on the BSV network. This has the effect of creating competition amongst miners on the network, which in turn keeps the price of processing transactions attractively low for users. Currently, the BSV network can process a single transaction for a fee that is a fraction of a US cent, and it is expected that further network scaling will reduce this cost.

Transaction fees and use cases

The Bitcoin SV infrastructure team has also embarked on the development of horizontal scaling systems through the recently revealed Teranode open framework, which should enable the BSV network to process more than 100,000 transactions per second – far more than any traditional digital payment network. The stability of the underlying original Bitcoin protocol also means that the economic incentives of the network are set in stone, and it is partly for this reason that fees are expected to remain low as the network scales.

Seibane believes that transaction fees on the BSV network may get even cheaper than they are now, especially following the advent of the Teranode framework and the increased adoption of the network by enterprises and businesses of all sizes.

‘When you look back at how the fees model has been working over the last years, I think it’s going to get even cheaper. I mean, the tendency has been always going cheaper and cheaper and cheaper. Maybe there are going to be some changes around business models for miners following the launch of Teranode, but I am quite confident on the fees staying as they are or getting even cheaper,’ Seibane says.

‘It is a mix of how the transaction fee model has been working in the past few years and the miner incentives. That is what gives us the confidence to rely on [fees staying low] because again, we have to rely on this. When you think about it, if fees go high there are no nanopayments.’

Nanopayments not only allow for one person to send money to another with almost no charge – they also enable a range of new use cases, most of which have not even probably not been envisioned yet. When transaction fees are low enough, the possibilities are endless. Businesses could launch data access platforms that charge a nominal nanopayment per access request, scaling their income with the adoption of their business; online publications could shirk traditional digital advertising and subscription models in favour of a pay-per-article model that charges a small fee the first time a reader accesses content. The security and immutable record provided by the BSV public ledger gives users and businesses assurance of their income and expenditure, and they can easily identify and isolate bad actors from the network if necessary.

A number of potential use cases for nanopayments on the BSV network are listed on the Bitcoin SV website, and are reproduced below:

- Paying a specific miner a small amount of satoshis to return you a Merkle proof when a transaction is mined.

- Paying a specific miner to watch for and notify you of double spends.

- Payments to a Paymail host.

- Paying a channels server to store and forward your messages while you are offline.

- Paying for insurance or countersigning by a specialist multi-signature custodian.

A key component of blockchain technology and the Bitcoin protocol is that it removes third parties from the payment process, which is what allows transaction fees to remain so low as there is no middleman payment processor. Another helpful result of this design is that it gives users and businesses full control over their money. If you are the only one to hold the private key to your Bitcoin address, only you can move money out of your wallet to any service. This is another crucial component of the nanopayment ecosystem, as it allows users to have full transparency over every small transaction exiting and entering their wallet, no matter how small or frequent.

Dust and consolidation transactions

Low transaction fees may be the key enabler of nanopayments on the BSV blockchain, but they also allow for a phenomenon known as ‘dust’. Dust refers to payments of satoshi amounts that are so small they are negligible when compared with the transaction fees on the network. In its deviation from the original Bitcoin protocol, the BTC development team enforced a dust limit – a lower bound on the amount of satoshis to be sent in a single transaction which aimed to prevent against ‘dust attacks’.

Dust attacks occur when one user sends trace amounts of satoshis to potentially thousands of Bitcoin addresses with the hope that activity involving these UTXOs will help to deanonymize the target addresses. There is no compromise of the address’s security in this type of attack – it is only an attempt to recognise patterns and potentially identify which Bitcoin addresses are connected to the same user through their activity.

While the dust limit did reduce the viability of this type of attack, there is a far simpler solution which is aligned with the original vision of the Bitcoin protocol: dust consolidation transactions. In a protocol restoration update code-named RAILS released by the Bitcoin SV infrastructure team in September 2020, the BSV network added support for dust consolidation transactions and began to remove the archaic dust limit. These consolidation transactions are an elegant solution in that they are free, but miners are still incentivised to process them.

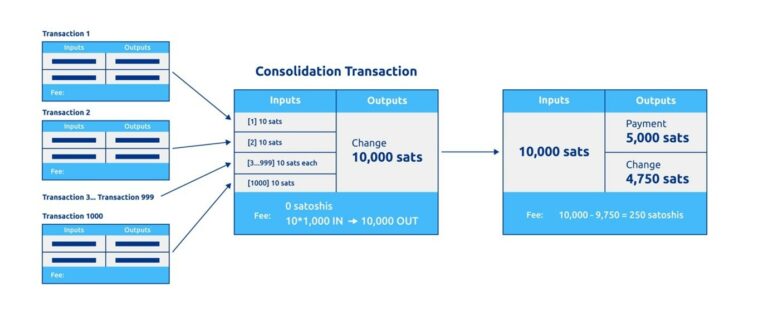

The effect of processing free dust consolidation transactions is that the final transaction fee reward from a payment made by through the consolidated UTXO is higher than the aggregation of many UTXOs in a single block. Consolidation transactions also shrink the UTXO database, which is a net benefit for miners on the network. The image below shows how consolidation transactions function on the BSV blockchain:

Seibane notes that consolidation transactions are an important factor in enabling nanopayments, as it makes it much easier for miners to process these UTXOs. It also means that small legitimate payments can be consolidated into single transaction, making them far more viable while preserving the identity of the user.

‘[Dust consolidation transactions] are one of the technical elements that are important for nanopayments. Because of how the UTXO model works in Bitcoin, if you are receiving many, many. nanopayments but you don’t spend them, there is a point where you can get to thousands of UTXOs. Then there is a point when maybe you want to spend 50 cents, but you have so many UTXOs and you have to pay many fees because you pay fees based on the bytes you are using in the transaction,’ Seibane explains.

‘That is not just only because of the fees, it is because of the performance. It is not the same to sign just one UTXO as when you have to sign 2,000 UTXOs – it takes more time and the user experience is different. So, ideally, we want to keep the UTXO count for each account in a range from around 50 to 300. How can we solve that? With free consolidation transactions.’

HandCash has been making use of these free consolidation transactions since February 2021 and has seen great success in its deployment of the solution. It is important to note that the rules governing the definition of consolidation transactions are specifically designed to prevent the abuse of free consolidation transactions and grant miners assurance that processing these payments is economically viable.

Payment channels vs nanopayments

Many blockchain protocols which do not offer the scalability or low transaction fees of BSV use more complex network features to attempt to offer nanopayment functionality. One of these features which is also available in BSV is payment channels. Payment channels comprise an off-chain calculation of sequential transactions which are then recognised on-chain once they are completed. This means that transaction fees need only be paid when the channel is opened and then once again when it is closed. There are many viable applications of this solution, but it is important to note that it includes added complexity and is not designed to support nanopayments across multiple users.

Seibane explains that the most important difference between on-chain nanopayments and payment channels to him is the fact that on-chain payments are processed immediately and efficiently with no additional transactions. He stresses that the concept of each payment action reflected as one transaction on the BSV network is simple and easy to follow, and ultimately provides more transparency for users, although there are certain applications where payment channels would be useful.

‘To me, the main difference is in the interaction. With a payment channel, every time there is a new interaction you update the payment channel but the interaction is not closed yet. In our cases and most of the places where we use nanopayments, there is no extra interaction – the interaction is atomic. I think this is why payment channels are so misunderstood, and also it is really hard to find a particular use case where they fit. There are many ways of doing the same thing, and payment channels are more complicated than the alternatives,’ Seibane says.

‘The main difference with payment channels in BSV compared with other protocols is that the others are using payment channels as an alternative to the high fees that they have. We don’t have to use them on BSV because of the fees – we use them because they are another use case. We like the concept of one transaction representing one action. Also, we don’t want to be messing up things and mixing inputs from different users because then we are making things more complicated. If we consider regulation and compliance, it makes it easier for companies to explain what is going on if you have transactions that you can explain very easily.’

This is not to say that there are no use cases for payment channels, however – they can be used for everything from recording transactions between parties that transact frequently to facilitating correspondence verified by the channel-opening transaction on the blockchain. Nanopayments enabled via standard, low-fee blockchain transactions are much simpler, however, and are completely viable on the BSV network in extremely high volumes.

HandCash has endeavoured to make the integration of nanopayments even more simple through their HandCash Connect platform, which allows businesses to set up nanopayments in a few minutes using simple API calls. These payments run on the BSV network and are denominated in Duro – a denomination created by HandCash that ‘wraps’ a certain amount of satoshis for even greater accessibility. From a business or user’s perspective, the exposure to the ‘plumbing’ of the BSV network is minimal – they are simply able to pay impressively small amounts to service providers instantly and with ultra-low transaction fees.

Seibane explains that if you are looking to implement nanopayments into your business, the HandCash Connect platform handles all the technical aspects, allowing you to focus on why nanopayments are important to your company and its offering. He uses the example of explaining nanopayments in eSports – a major market for the adoption of blockchain payments – to explain how businesses should think about interoperability and nanopayments in their games.

‘Integrating nanopayment takes a few minutes with HandCash Connect, so it is more about the use case that you want to build around: how do you want to sell it? How do you want to explain to your producers what Duro means and why you can use in this game and then in other games?’ he says.

Seibane adds that HandCash has seen significant interest from developers, start-ups and enterprises across various industries, all of whom are excited to integrate nanopayments into their applications using HandCash Connect.

The eSports industry is a sector where HandCash has seen particular interest, and Seibane notes that they are constantly refining their platform and adding features requested by users to make the process of integrating BSV-based nanopayments into applications as easy as possible.