Muhammad Salman Anjum is Chief Mate of InvoiceMate, Head of the BSV blockchain Hub for MENA & South Asia, a TEDx Speaker, PwC’s Trainer and named as one of the ‘Top 100 Global Blockchain Leaders’ in the world. As a Founder and Chief Mate of InvoiceMate he is co-creating the future of invoice processing with blockchain enabled trusted process and enhanced efficiency.

In June 2021, Muhammad took to the stage at the CoinGeek Zurich conference to talk about how InvoiceMate solves the real world business issue of inefficient invoice processing and how this results in saving professionals much effort, time and resources.

How InvoiceMate is addressing problems within the invoicing, digital transformation and the digital currency arenas

InvoiceMate is targeting three problems in three different areas: digital transformation, blockchain and invoicing.

Problems with Digital Transformation

First and foremost, InvoiceMate is addressing digital transformation in the corporate world. Current digital transformation, or Digital transformation 1.0 has numerous problems, among them are data silos, a lack of integrity, overly centralised workflows, and a broken architecture.

1. Digital transformation is creating silos as well as redundancy of the data. This was acceptable in the digital transformation of ten years ago, but today we realise the importance of connectivity in order to bring about optimised data utilisation.

2. Lack of integrity. Digital Transformation 1.0 is not built upon a trusted layer. With the advent of blockchain, Digital Transformation 2.0 can make use of its infrastructure for built-in integrity of our processes and workflows.

3. Workflows are overly centralised. While centralisation is not bad in itself, it’s overly centralised systems that create issues like silos, redundancy and lack of exchange of the data.

4. Moving forward, it will become increasingly obvious that systems built according to Digital Transformation 1.0 principles are based on broken architectures.

Problems in blockchain ecosystem

I’ve been in the space of enterprise blockchain for the past four and a half years where I’ve recognised a number of issues.1. A disconnect exists between blockchain technology and digital currency. The misinformation going around is preventing people in conventional businesses from experiencing blockchain for themselves.

2. A lack of production grade blockchain applications. A lot of businesses, governments, banks and financial institutions are doing proof of concepts, but they’re basically pilot projects. We need to move beyond POCs to production grade applications that can bring about real-world blockchain adoptions.

People often ask me why digital currencies are so volatile. Adoption is one of the ways that will address this pain point.

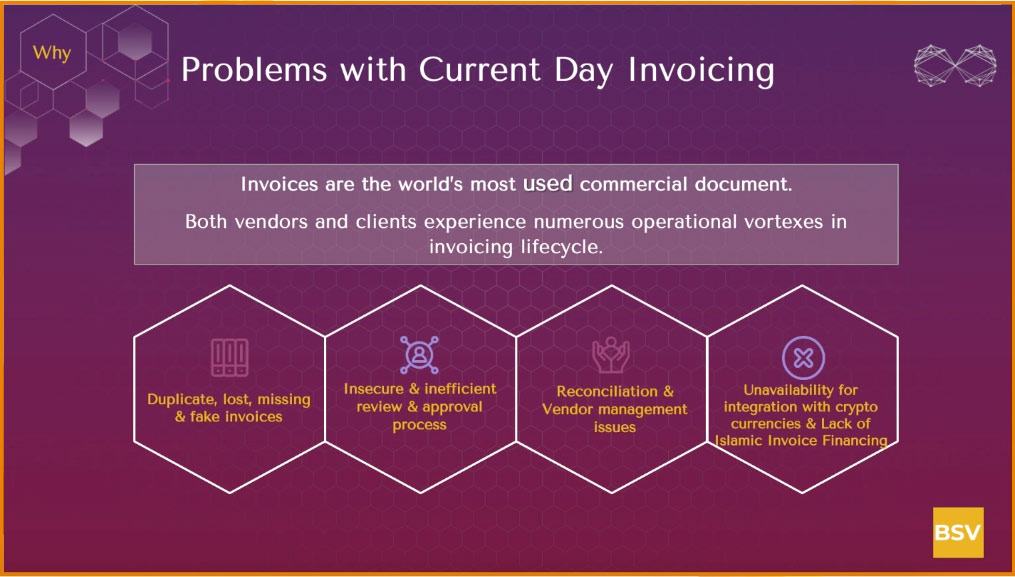

Problems with current-day invoicing

InvoiceMate is also focussed on solving problems with the current invoicing model.

We all act as a vendor or a client at times, receiving numerous invoices. There are numerous pain points in this industry.

1. Fake invoicing, under invoicing or over invoicing.

2. Insecurity and inefficiency of the whole process.

3. Reconciliation and supplier management issues

4. Unavailability of integration with cryptocurrencies and lack of Islamic Invoice Financing.

The intersection between blockchain, digital transformation and invoicing

Blockchain intersects with both invoicing and digital transformation by providing a trusted layer to solve the trust issues of the other two sectors.

Then there’s the disconnect between digital currencies and conventional businesses. Let’s take Elon Musk’s 2021 announcement that Tesla would invest in Bitcoin. It took the company another three weeks before they could accept payment in Bitcoin. The reason for the delay was that they had to upgrade their backend systems and accounting packages to enable the operation.

The whole world is lacking in the area of integration between digital currencies and ERP systems or conventional accounting packages. This is going to be one of InvoiceMate‘s top applications, and it will reside on existing ERP and accounting packages to add value and give more life to conventional solutions.

The opportunities of invoicing

Invoices are the world’s most used commercial documents and there are many opportunities available in the space.

There’s the invoice financing market, which is heading towards the trillion dollar market, growing at a rate of 7.5 per cent annually.

There’s Accounts Payable Automation, which is a four billion dollar market, growing at seven percent annually.

Then there are digital currencies, a 1.5 to two trillion dollar market growing exponentially.

Blockchain for Islamic financing needs

There’s also a need for blockchain in Islamic financing. In Islamic financing, compliance demands a two-layer audit process. The first is a conventional audit, and the second one is Islamic of Sharia compliance.

So, blockchain smart contracts will enable automated compliance of Islamic finance systems to ease the process and save on costs in this 2.5 Trillion US dollar market.

InvoiceMate goals

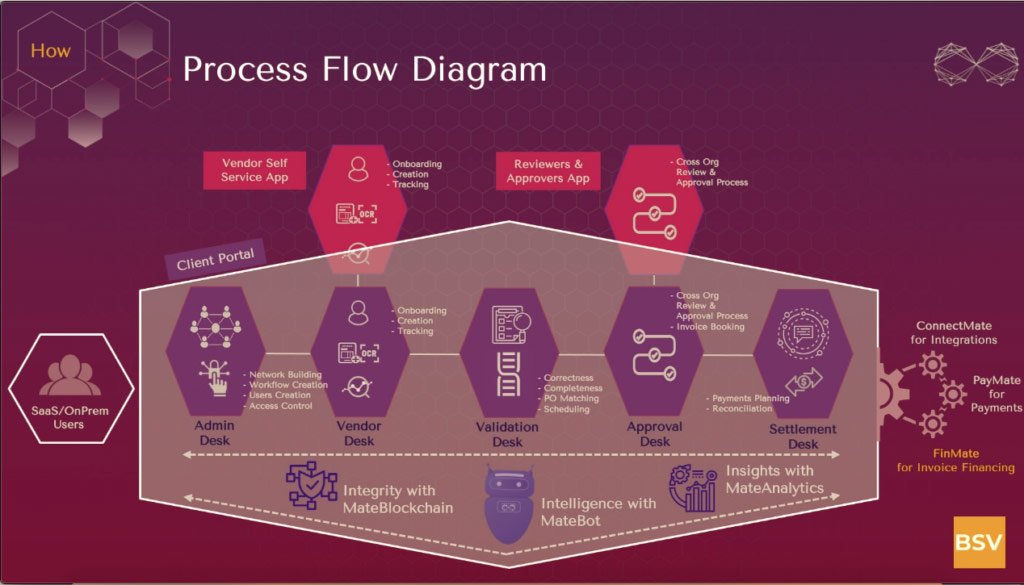

InvoiceMate is a trusted system for invoice generation, processing, payments and financing – an end-to-end solution.

InvoiceMate is going to be a bridge connecting conventional businesses with a trusted and efficient business workflow for Digital Transformation 2.0. It will also be a bridge between conventional businesses and digital currencies. On top of that, it will serve Islamic financing.

InvoiceMate Methodology

How are we going to do the above? Our methodology is to convert a caterpillar into a butterfly, instead of converting it into a faster caterpillar. We don’t want to only focus on invoice generation, or invoice payments, or invoice financing.

If you really want to bring about transformation, you have to reinvent the entire process from the outset and follow it through the entire journey.

Users will come in to our SAAS-based invoice processing software, reach out to the invoice generation, payments or invoice financing function to complete their journey on the blockchain with an element of AI.

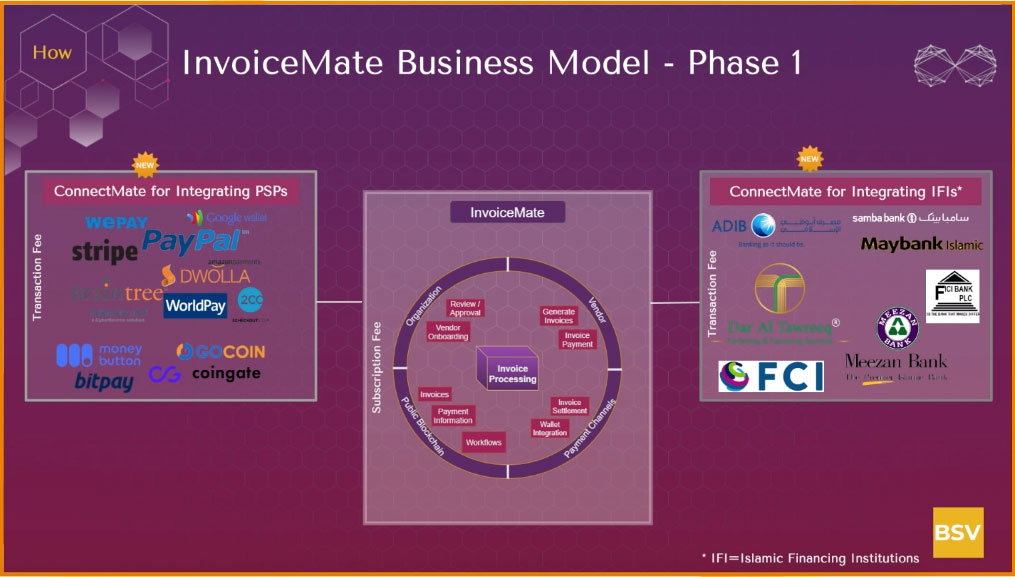

InvoiceMate Phase 1

At present, InvoiceMate is integrated with vendors all the way to financiers.

On the one side, you can see how users are interacting with the invoice made as vendors, and then they can reach out to the existing payment service providers to pay out the way the invoices.

On the other side, you can see the integration with the existing international Islamic financial institutions who are doing the factoring and financing of the invoicing.

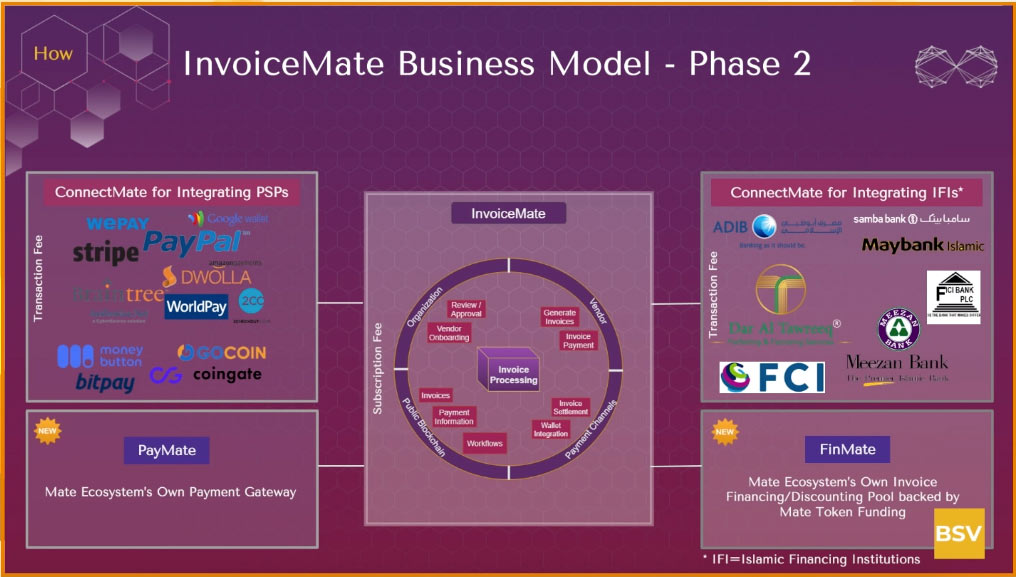

InvoiceMate phase 2

Moving forward, the vision is to have our own Paymate as payment service provider. On the other side of the diagram, we’ll have FinMate as our own liquidity pool for funding the invoice financing clients.

FinMate will work with the MATE token. It will be the first Sharia compliant, Islamic rules-based token.

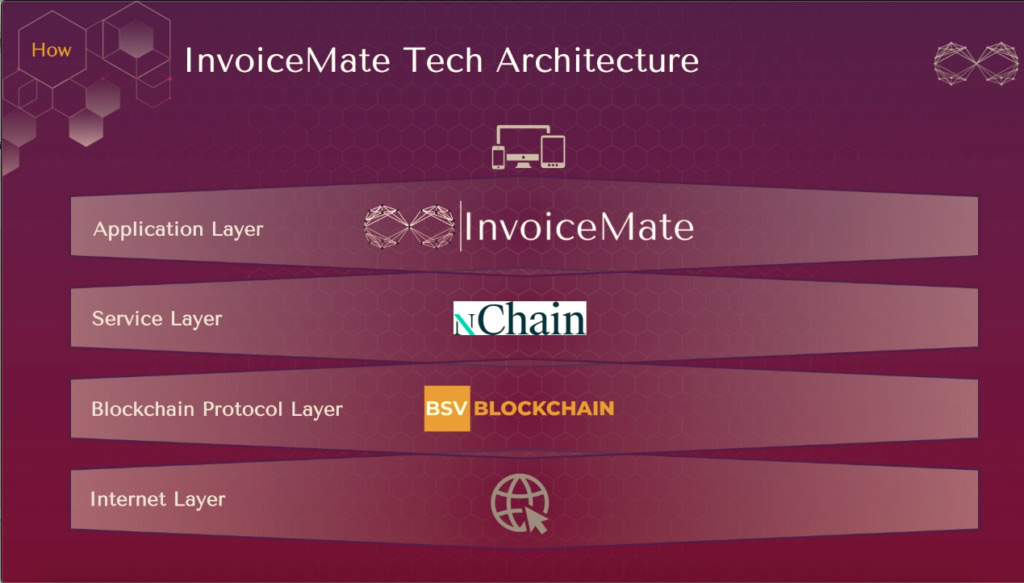

InvoiceMate Tech Architecture

We will be using the Internet as a foundation layer, on top of it there will be a BSV blockchain protocol layer. Then we’ll work with nChain as a service provider to connect our application layer with the blockchain protocol layer. And finally, you can see InvoiceMate sitting on the top, so users can interact with the software through their mobile devices, desktops or laptops.

InvoiceMate features

1. A trusted system of workflow of the whole invoicing process.

2. Functional features: We are working with the topmost advisors in the financial space, to gain insight into the controls CFOs and financial teams are looking for. InvoiceMate is not just a blockchain app, it’s meant for the businesses to solve their problems.

3. We’ve paid a lot of attention to user experience and user interface, and provide access via mobile devices as well. There are specific apps for the approval and for the whole vendor management system.

4. Integration. Conventional systems are here to stay. You cannot replace legacy architecture immediately. Our application will just sit on top of the existing architecture, will speak with it, will be integrated into it and will give it more life.

5. Compliance. The app will take care of GDPR, financial, audit and other areas of compliance.

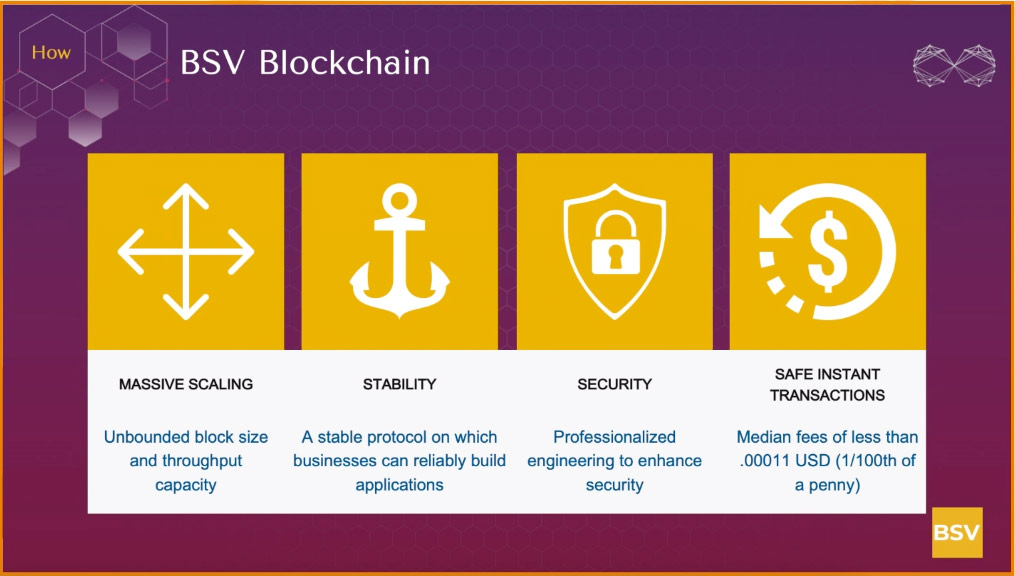

Getting the benefit of blockchain with the BSV blockchain

How are we getting the benefit of blockchain? The BSV blockchain is the leading enterprise blockchain, and it’s a public blockchain at that. Initially, we went with permissioned blockchains, but since we discovered BSV we’ve found our solution.

BSV’s incredibly low transaction fees and throughput played a big role in our choice. But what really tempted us to public blockchain is the ecosystem that’s being built on the BSV blockchain, for example, nChain that’s bringing us a service layer and mapping of data, MoneyButton for our payment service providers or wallets, and Fabriik to explore our token platform, and TAAL as transaction processor to negotiate a fixed rate.