The rising popularity of Bitcoin mining, exacerbated by global interest in speculative investment around cryptocurrency and blockchain-based tokens, has led to widespread concerns over the electricity consumed by Bitcoin miners. Bitcoin Core (BTC) is the main culprit targeted by critics, as it has been shown to consume inordinate amounts of power and translate this energy towards its primary function with great inefficiency.

Bitcoin’s energy consumption is a result of its SHA-256 proof-of-work consensus mechanism, which requires miners to solve complex cryptographic puzzles to validate blocks of transactions that are then appended to the blockchain. This validation requires the use of specialised hardware by miners, who compete to output the most hashing power and therefore the opportunity to validate blocks and receive rewards.

This energy problem is not a necessary product of SHA256 proof-of-work blockchains, however, as demonstrated in a recent by Canadian accountancy, tax and business consulting firm MNP. The report, titled ‘Blockchain technology and energy consumption: The quest for efficiency’, finds that the Bitcoin Satoshi’s Vision (BSV) blockchain, while based on the original Bitcoin protocol, offers far greater energy efficiency than Bitcoin Core (BTC) and Bitcoin Cash (BCH).

The report finds that the BSV blockchain achieves this much greater energy efficiency due to its implementation of the Bitcoin protocol, which is more aligned with the original vision described in Satoshi Nakamoto’s white paper. The key distinction between BSV and the other two blockchain protocols is the former’s lack of arbitrary limitations on block size and therefore transaction throughput, which MNP found to be a major factor in the widely-cited ‘energy problem’ of Bitcoin mining.

‘The three Bitcoin protocols, BTC, BSV, and BCH, were compared to see which was more efficient. Given that all Bitcoin protocols are subject to the mining difficulty being affected by the computational potential of the miners on them, the metrics for efficiency were kilowatt-hours per transaction and kilowatt-hours per megabyte validated,’ the report states.

‘BSV is more efficient due to block size and number of transactions (throughput) currently available on the network and limitations of other protocols. So long as the size or number of transactions on the BSV network exceeds the limitation of the other protocols, BSV is the most efficient in this group.’

Before exploring how the BSV blockchain’s scalability offers much-improved energy efficiency compared with BTC and BCH, it is important to consider the previous work conducted around energy efficiency and Bitcoin mining.

The Bitcoin energy problem

In creating its energy efficiency models and preparing its comparison of these three Bitcoin-based protocols, MNP began by noting the previous research done in this space. Many studies have highlighted the problem with Bitcoin mining on the Bitcoin Core (BTC) network, finding it to be especially inefficient and inordinately power-hungry when accounting for the blockchain’s limited transaction throughput.

One of the studies cited in MNP’s report is a 2018 paper by Alex de Vries, titled ‘Bitcoin’s Growing Energy Problem’. De Vries highlights the significant electricity consumption by miners operating on the BTC network, which can be measured against that of developed nations. He is also quick to note the disproportionately low and static transaction throughput of the BTC network despite its growing energy consumption.

‘The Bitcoin [BTC] network can be estimated to consume at least 2.55 gigawatts of electricity currently, and potentially 7.67 gigawatts in the future, making it comparable with countries such as Ireland (3.1 gigawatts) and Austria (8.2 gigawatts). Economic models tell us that Bitcoin’s electricity consumption will gravitate toward the latter number,’ de Vries states.

‘As per mid-March 2018, about 26 quintillion hashing operations are performed every second and non-stop by the Bitcoin network. At the same time, the Bitcoin network is only processing 2–3 transactions per second (around 200,000 transactions per day). This means that the ratio of hash calculations to processed transactions is 8.7 quintillion to 1 at best. The primary fuel for each of these calculations is electricity.’

MNP’s study finds similar evidence for the poor energy efficiency of the BTC network, especially with regards to the processing of transactions enabled by proof-of-work block validation. In comparing BTC with the BSV blockchain, however, the report adds that because BSV can fit a theoretically unlimited number of transactions in a single block, the energy efficiency improves as the transaction throughput of the network grows.

‘Results indicate BTC consumes orders of magnitude more power than either of the other two protocols tested. The estimated consumption difference between the protocol with the most consumption (BTC) and the protocol with the least consumption (BSV) is at its most (16,041.24 GWh) in Q1 2021, and its least (11,343.25GWh) in Q2 2020 as per our model’s output,’ MNP states.

‘Our estimates indicate BTC consumes between 60 and 250 times the power of BSV per quarter.’

BSV’s scalability as a solution

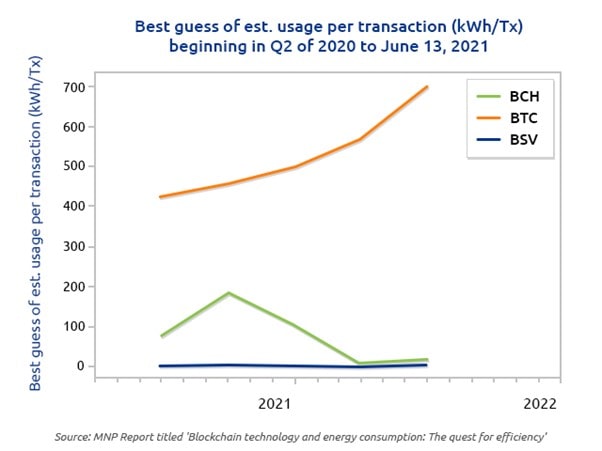

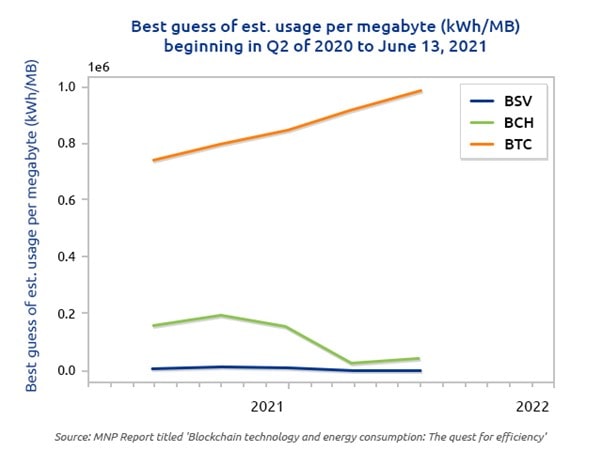

The BSV blockchain’s increased energy efficiency is demonstrated on both a per-transaction and per-megabyte basis, referring to the amount of electricity consumed for the blockchain to process a single transaction and megabyte of data, respectively.

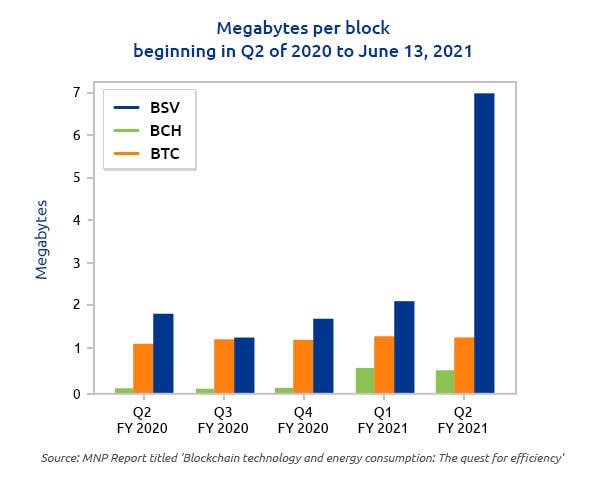

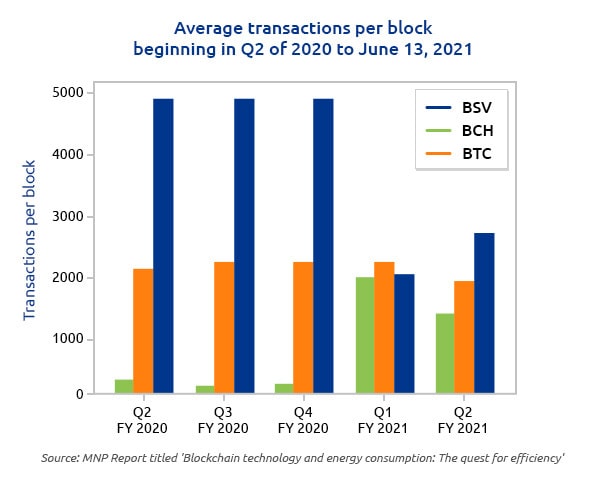

‘Transactions are the ultimate measure of throughput. The number and size of the transactions in a block will affect the size of the block. BTC has a strictly limited block size approaching 4MB. BCH has a much more permissive limit of 32MB. BSV is unbound by block size,’ MNP states in its report.

‘Since mining is what consumes energy, and blocks are the product of mining: the more transactions in a block, the lower the energy consumption per transaction. Similarly, the larger a block can be (measured in megabytes), the lower the energy consumption per megabyte.’

Thanks to its lack of arbitrary block size limits, the BSV blockchain can scale unbounded and continually improve its transaction throughput while still retaining the benefits of proof-of-work – the securing of validated blocks by miner hash power and network consensus. This simple lack of restriction on block size has major implications for energy efficiency and the blockchain’s subsequent effect on the environment, however.

The energy consumption differences between BSV and the other two blockchain protocols are extremely clear when viewed in conjunction with the ‘ultimate measure of throughput’, transactions, as well as the energy cost of processing one megabyte of data on the network.

Firstly, by comparing the average transactions and data per block, it is immediately apparent that BSV offers greater scalability and therefore processing efficiency than both BCH and BTC. This greater efficiency is even more demonstrable when considering the upper bounds of each protocol’s transactions and megabytes per block.

The graphs below show the average transactions per block and megabytes per block of BSV, BTC and BCH, according to the MNP report. Note that these illustrations do not reflect the peak figures, which would favour BSV with an even greater discrepancy.

The differing scalability of each blockchain protocols is apparent, but can BSV’s unbounded scaling translate to efficiency and solve Bitcoin’s ‘energy problem’? When viewed in applicable terms of kilowatt-hours (kWh) consumed per transaction and megabyte (MB) of data processed, yes.

MNP finds that, according to its estimates over the period from Q2 2020 to Q2 2021, the BSV network requires an amount of energy much smaller than BCH, and orders of magnitude smaller than BTC, to process a single transaction or megabyte of data.

‘For BTC, the consumption per transaction steadily increases over time. The estimate beginning Q2 2020 has the average consumption at 430 kWh/tx through to 706 kWh/tx in Q2 2021. The estimated consumption per megabyte follows the same pattern, going from approximately 757 MWh/MB in Q2 2020 to 991 MWh/MB,’ the report states.

‘The estimated consumption per transaction peaks for BCH in Q3 2020 at 183 kWh/tx and falls as low as 6.5 kWh/tx in Q1 2021. The estimated consumption per megabyte follows the same pattern, with a maximum of 194 MWh/MB in Q3 2020 and a minimum of 20.5MWh/MB in Q1 2021.’

For BSV, however, the estimated consumption for both transaction and megabyte throughputs remains relatively consistent and considerably lower.

‘[For BSV], the consumption per transaction ranges between 3.3 kWh/tx in Q3 2020 and 2.4 kWh/tx in Q2. The consumption per megabyte 12.63 MWh/MB and 0.9 MWh/MB in Q2 2021.’

These large differences in energy efficiency, and the ability for BSV’s unbounded scaling to solve Bitcoin’s energy problem, are shown in the graphs below.

Click here to read the full report by MNP on blockchain technology and energy consumption.