For the newly initiated to the world of Bitcoin, the virtual currency trading under the BTC ticker is one of a sort, kickstarting a range of derivative cryptocurrencies.

For those who dig a little deeper, you’ll soon discover three projects contending for the Bitcoin brand name: Bitcoin Core (BTC), Bitcoin Cash (BCH) and Bitcoin SV (BSV).

So, what gives?

Though the topic tends to provoke strong political and ideological opinions, the best way to get a grip on the different projects is to delve into the technical choices and underlying value propositions that have driven their development.

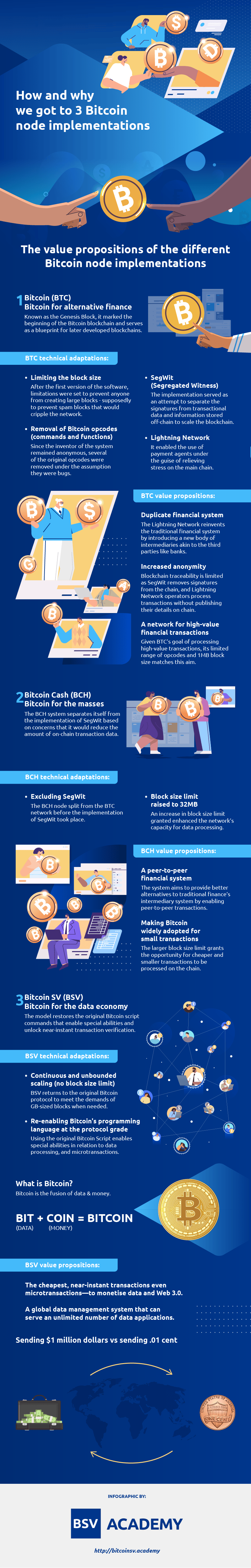

The value propositions of the different Bitcoin node implementations Bitcoin (BTC) – ‘Bitcoin for alternative finance’

On January 3, 2009, Satoshi Nakamoto mined the first block, known as the Genesis Block, marking the beginning of the Bitcoin blockchain. In this 13 year period, BTC has undergone numerous technical adaptations, including:

– Limiting the block size: The first version of the Bitcoin software posed no limit to the block size. Hal Finney, one of Bitcoin’s first developers feared the possibility of DoS attacks where someone could create huge ‘spam blocks’ to cripple the network. As a preventative measure, he proposed the implementation of a 1 MB block size limit. The BTC project has maintained this block size limit until present (January 2022).

– Removal of Bitcoin opcodes (commands, functions): As Bitcoin’s inventor remained anonymous for the first years after the project’s launch, several of the opcodes were difficult to place. Assuming they were bugs, the BTC project removed them.

– The implementation of SegWit (Segregated Witness): in an attempt to scale the BTC blockchain, signatures were separated from transactional data and stored off-chain.

– The Lightning Network: although SegWit wasn’t an adequate fix for BTC’s scaling problems, it enabled the introduction of payment agents. These serve as middlemen to facilitate bi-directional payment channels to reduce the burden on the main chain. In this Lightning Network, the details of individual payments are not recorded on the blockchain so that node operators can’t see the source or destination of non-adjacent funds.

The technical choices of the developers behind the BTC chain are telling of the value proposition of the project.

– The Lightning Network, as the most recent iteration of BTC’s scaling strategy, has created a duplicate financial system where its operators act as intermediaries, instead of banks or other traditional third-parties.

– As individual payments are left off the chain, the LN removes the traceability of the blockchain and introduces a level of anonymity.

– The fact that BTC has maintained its 1MB block size cap and their limited range of opcodes correlates with its promotion of Bitcoin as a network for high value financial transactions. Bitcoin Cash (BCH) – ‘Bitcoin for the masses’

The main reason Bitcoin Cash separated from the Bitcoin (BTC) network was over the introduction of SegWit. Bitcoin Cash developers believed that SegWit’s routing of transactional data to off-chain channels would contradict the principle of peer-to-peer transactions.

Additionally, some miners expressed concern over the impact SegWit would have on their mining revenue, as it would reduce the amount of on-chain transaction data (and therefore the amount of fees).

From a technical perspective:

– The Bitcoin Cash node implementation was born before SegWit took into effect, excluding it from the new project.

– Bitcoin Cash raised its block size limit to 32MB to allow for more transactions to be processed on-chain.

From the perspective of value proposition:

– Bitcoin Cash strives to provide an alternative means for financial transactions between peers, without the involvement of intermediaries.

– By raising its block size limit to allow for more, cheaper transactions to be processed on-chain, Bitcoin Cash pursues the goal of making Bitcoin widely adopted for small transactions. Bitcoin SV (BSV) – ‘Bitcoin for the data economy’

Like Bitcoin Cash, Bitcoin SV (Bitcoin Satoshi Vision) refrained from implementing SegWit. Other technical aspects that differentiate it from the other two node implementations include:

– A focus on continuous and unbounded scaling. By means of a ‘Genesis hard fork/upgrade’, BSV terminated a block size limit entirely, returning to the original Bitcoin protocol. As a result, the chain has been able to produce GB-sized blocks whenever demand arises.

– Through the Genesis update, BSV reintroduced the opcodes that BTC removed, enabling an entire programming language at the protocol grade.

By doing away with the artificially manufactured block size limit and re-configuring Bitcoin Script commands, BSV enabled specialised capabilities and the cheapest, near-instant transactions – even microtransactions.

And where most Bitcoiners focus exclusively on the ‘coin’ part of the word, BSV has rediscovered the ‘bit’, or data functionalities that were built into Bitcoin from the start.

By re-enabling Bitcoin Script language, high-level data management and analysis capabilities were unlocked. By focussing on unbounded scaling, the network aims to become a global data management system that can serve an unlimited number of data applications. BSV: the blockchain for the data-based economy

By returning to Bitcoin’s original design, the BSV blockchain is on track to deliver the protocol and infrastructure necessary for the fourth industrial revolution. Inherent to this system are the qualities of stability, security, scale and sophistication that a data-based economy demands.

To learn more about the BSV blockchain and why it is the infrastructure for the data economy, download our eBook below.