Blockchain technology is a game-changer that alters how industries conduct their processes worldwide via endless functional possibilities. As the technology evolves, consumers and businesses discover innovative ways to harness its power for unique applications.

One of the most transformative applications of blockchain is securing and streamlining cross-border payments. This development benefits your business, as blockchain can enhance operations and improve customer relationships.

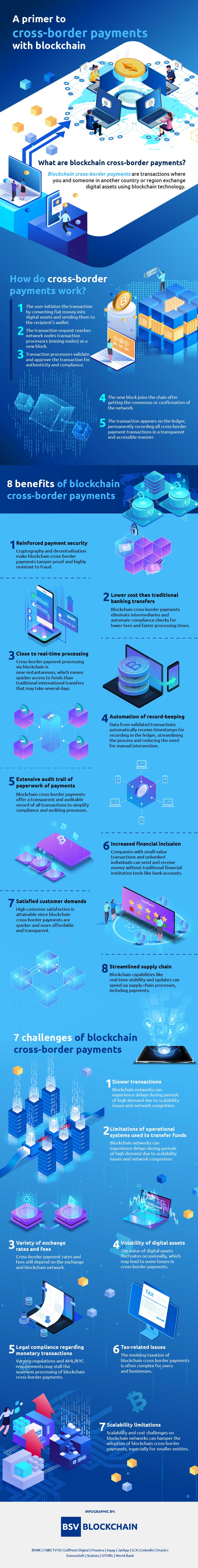

As you’ll learn in this infographic, cross-border payments with blockchain have benefits and challenges.

What are blockchain cross-border payments?

Blockchain cross-border payments involve exchanging digital assets with another party from a different country or region using blockchain technology.

Unlike traditional cross-border payment methods—which often involve intermediaries such as banks and payment processors—blockchain-based cross-border payments rely on decentralised and secure digital ledgers to facilitate these transactions. Because of its convenience, it accounted for 15.9% of the $4.67 billion blockchain market in 2021.

Over 542 million business-to-business blockchain cross-border transactions also occurred worldwide in 2022. Most of them happened in Asia, with Europe, North America and the rest of the world following suit. As blockchain continues to evolve and enable payments, B2B blockchain cross-border transactions will likely reach 1.7 billion by 2025.

How do cross-border payments work?

The straightforward process of cross-border payments with blockchain allows a faster and more secure way to send and receive money internationally.

1. The user initiates the transaction

A user who may be your company or its customer or supplier utilises an on-ramp service or exchange to convert fiat money into digital assets. When initiating a cross-border transaction through a digital wallet, details like sender and recipient names and the amount are necessary.

The transaction will be bundled with other pending transactions to form a ‘block.’ It will serve as a container for multiple transactions.

2. The transaction request reaches transaction processors (blockchain miners)

The creation of the newly created block alerts the transaction processors in the network. These processors, or mining nodes are present across the blockchain network as validators and record-keepers.

3. Transaction processors (miners) validate and approve the transaction

Among the things that transaction processors check for authenticity include the sufficiency of funds, adherence to network rules, and duplicate or unauthorised transactions.

4. The new block joins the chain

After validation and consensus, the existing blockchain adds the new block. The latter becomes a permanent part of the blockchain’s history following a chronological order with the previous blocks.

5. The transaction appears on the ledger

The last step involves the blockchain permanently documenting transactions on the ledger. It includes details such as sender and recipient wallet addresses, transaction amounts and timestamps. This ledger is accessible to all network participants, ensuring transparency.

8 benefits of blockchain cross-border payments

Blockchain technology offers many advantages for international transactions. These benefits address longstanding challenges while introducing innovative features that enhance payment transfers.

1. Reinforced payment security

Blockchain cross-border payments offer robust security. Cryptographic techniques and blockchain’s decentralised nature make the technology exceptionally difficult for unauthorised parties to tamper with transaction data.

Once the blockchain records a transaction, it becomes immutable and highly secure. This layer of security reduces the risk of fraud and ensures the integrity of the payment process.

2. Lower cost than traditional banking transfers

Traditional cross-border payments often involve a web of intermediary banks and financial institutions that charge extra for currency conversion and processing. Blockchain eliminates many of these additional steps, significantly lowering transaction fees.

3. Close to real-time processing

Unlike traditional international transfers that take several days, cross-border payments via blockchain are faster due to the technology’s near real-time processing capabilities. Blockchain enables quick access to funds for senders or recipients, which is particularly advantageous when timely payments are crucial.

4. Automation of record-keeping

Blockchain can communicate with relevant systems like currency exchange platforms and use their data to automate the timestamping of transaction records. This automation streamlines the payment process and reduces the need for manual intervention.

5. Extensive audit trail of paperwork of payments

Since blockchain records remain on a public ledger, the network has an extensive and immutable audit trail of payment transactions. This feature also simplifies compliance processes, including anti-money laundering and other regulations.

6. Increased financial inclusion

According to the World Bank, 1.4 billion adults worldwide remain unbanked because they lack access to traditional financial services like bank accounts and credit cards. If you have a small business, you do not need a bank account to make cross-border payments through blockchain.

The technology makes it easier for the unbanked to send and receive money.

7. Satisfied customer demands

Blockchain cross-border payments provide quick and accessible international transaction solutions. This benefit is advantageous if you run a business and want to accommodate customers from other countries. Your customers will surely appreciate the speed and efficiency of blockchain payments since they significantly reduce the waiting time for cross-border transfers.

Plus, lower fees and transparent transaction records meet the demand for cost-effective and trustworthy financial services.

8. Streamlined supply chain

You can benefit from blockchain cross-border payments if you have international suppliers and business partners.

First, blockchain enables real-time visibility into the movement of goods and funds across international borders, reducing the risk of delays and disputes.

In addition, smart contracts automate payment processes and trigger actions. For instance, your network or supplier can approve shipment release upon meeting predefined conditions instead of relying on manual intervention that may only lead to errors.

Meanwhile, the ledger’s permanent records enhance accountability and reduce fraud for all parties in the transaction.

7 challenges of blockchain cross-border payments

While blockchain has undergone tremendous changes since its inception, the technology is still imperfect. It’s best to manage your expectations when making cross-border payments using blockchain.

1. Slower transactions

Despite the promise of real-time or near-real-time transactions, some blockchain networks can still experience delays during periods of high demand. Scalability issues and network congestion can also contribute to longer confirmation times.

Unlike other protocols, BSV blockchain does not have this problem. In fact, BSV offers near instant transactions at a fraction of the price compared to other networks.

2. Limitations of operational systems used to transfer funds

The integration of blockchain technology into existing financial infrastructure can be complex. Traditional banking and payment systems may not seamlessly connect with blockchain networks, creating interoperability challenges. As a result, it becomes difficult to transfer funds between these systems efficiently.

Moreover, many businesses and customers are still unfamiliar with blockchain technology and its applications for cross-border payments.

3. Variety of exchange rates and fees

While blockchain cross-border payments offer reduced transaction costs, you may still encounter varying exchange rates and fees with blockchain platforms and service providers. Navigating these differences can be confusing and lead to unexpected expenses.

4. Volatility of digital assets

The price or value of digital assets can be volatile. They can fluctuate significantly over a short period. This unpredictability can pose risks, as the value of the transferred funds may change before you complete a cross-border transaction.

5. Legal compliance regarding monetary transactions

Regulatory compliance is a significant challenge in the world of blockchain cross-border payments.

Different countries have special regulations governing digital assets and cross-border financial transactions. Some still lack a legal framework for blockchain transactions. It’s common to encounter challenges in complying with anti-money laundering (AML) and know-your-customer (KYC) requirements.

The BSV Association strongly advocates blockchain regulation, stressing the importance of legal compliance within the industry. They work hand in hand with policymakers to craft regulatory environments that encourage lawful behaviour, fuel innovation and foster market growth.

This approach provides a clear understanding of obligations, promotes compliance, improves governance, instils trust, and attracts investments.

6. Tax-related issues

Taxation of digital asset transactions remains an intricate and continuously evolving area of regulation. As a consumer or business engaging in blockchain cross-border payments, you may face challenges related to reporting and paying taxes on your transactions. The varying tax treatment of digital assets from jurisdiction to jurisdiction can add to the complexity, too.

7. Scalability limitations

As a blockchain network becomes more extensive and congested, the time it takes to confirm and validate cross-border transactions can increase. The cost of processing them may also rise. Network or gas fees can become prohibitively expensive during times of high demand.

Likewise, running a full node on a blockchain network requires significant computational resources and storage capacity. Since the growth of a blockchain makes participating in the network more resource-intensive, smaller players might have limited means to engage in cross-border payment processing.

That said, not every protocol struggles with these challenges. BSV blockchain is highly scalable and comes at a low cost, opening up numerous doors of opportunity.

Prepare for a decentralised future

Blockchain technology makes sending and receiving money worldwide more streamlined and convenient. While blockchain cross-border payments offer several advantages over traditional methods, thorough research is essential for valuable financial transactions.

eBook: What the BSV blockchain is and why it is the infrastructure for the data economy

A well-suited blockchain for cross-border payments is BSV. Its infrastructure caters to a data-based economy, large transactions and complex smart contracts.

If you want to learn more about how you or your organisation can utilise BSV blockchain to its full potential and as a viable infrastructure for the new data economy, download our free ebook, ‘What the BSV blockchain is and why it is the infrastructure for the data economy’