A new study on blockchain sentiment reveals a widespread lack of knowledge and mistrust in emerging technologies

The BSV Blockchain has published its first annual Blockchain Barometer report in collaboration with the renowned research house, YouGov. The comprehensive survey has brought to light a concerning lack of knowledge and understanding regarding crucial emerging technologies, such as AI, cryptocurrencies, ChatGPT, blockchain, metaverse, Web3, and IoT.

This knowledge gap is, in turn, directly impacting the rate of adoption and public trust in these innovative technologies. Some of the key findings from the Barometer include:

- Widespread mistrust: 42% of respondents express distrust in all listed emerging technologies, including AI, Metaverse, ChatGPT, and more.

- Generational divide: Gen Z stands out as the most trusting generation, particularly in social media and AI with 38% believing they will become a part of their daily lives within the next five years.

- Brits least trusting: The United Kingdom ranks as the region with the least trust in emerging technologies, as only 15% indicated they trust and use AI in their daily lives.

Global perceptions: Brits are the most sceptical about emerging technologies

Comparing global perceptions, Spain, Sweden, and Germany express higher levels of trust in these technologies, with 36% of Spanish respondents demonstrating trust in and use of AI in their daily lives. By comparison, only 16% of UK residents and 15% of those in the US share this sentiment.

Furthermore, 46% of Spanish 18 – 24-year-olds express trust in AI, indicating the importance of age in shaping perceptions. Interestingly, 29% of German respondents and 37% of Spanish respondents believe they will incorporate blockchain into their daily lives within the next five years.

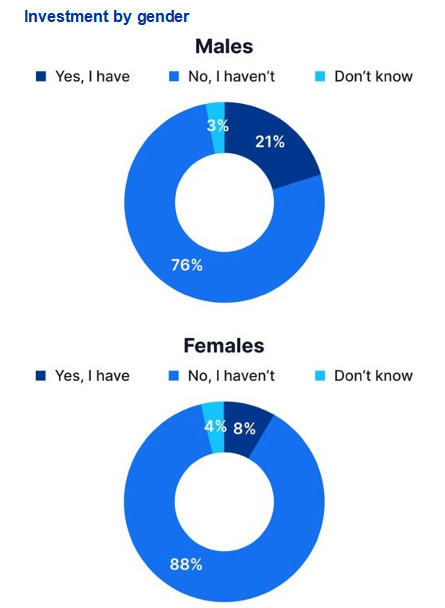

Gender disparities: Men more likely to own digital assets

Across the Barometer, notable gender differences emerge. Despite a general lack of knowledge, men are twice as likely in every region to have invested in digital assets, with 21% ownership compared to 8% for women.

Overall, women express less trust and belief in these technologies than their male counterparts. For example, when asked which technologies they trust for day-to-day activities like banking, bill payments, and shopping, women consistently exhibit lower levels of trust compared to men.

Gen Z: The torchbearers of emerging technology

While the overall findings paint a somewhat bleak picture of the future of emerging tech, Gen-Z respondents show a more positive outlook. This age group, aged 18-24, is more open to learning about these technologies, with 38% believing they will become a part of their daily lives within the next five years. Gen Z is particularly adept at understanding the similarities between crypto assets and blockchain and displays high trust in technologies, especially AI and Web 3. Additionally, they are most trusting of social media.

Priorities for wider adoption

Respondents around the world unanimously agree on the factors that would make them more interested in using blockchain applications for daily finances. The survey revealed the following distribution from the total number of respondents when it came to factors that could increase interest in blockchain technology:

- A better understanding of the benefits (30%);

- A better understanding of the technology (28%);

- A better understanding of how it is currently being used (27%).

Blockchain across industries

Despite a fundamental or intermediate understanding of blockchain remaining elusive for most consumers, they have ideas about the industries most likely to incorporate it in the next two years:

- Finance: 34%

- Healthcare: 26%

- Supply Chain: 19%

- Power: 18%

Although blockchain technology has the potential to benefit various industries, the respondents’ choice of Finance as their top priority might be due to the false notion that Blockchain technology is primarily a financial instrument. This is further supported by the finding that 59% of the global respondents were unsure whether blockchain and cryptocurrencies were similar or not.