The blockchain industry has witnessed a peculiar shift in attention, as the focus on crypto investigations and criminal activities has, to some extent, overshadowed the vast potential of blockchain venture capital investing.

While the emergence of crypto assets brought about revolutionary advancements in financial technology, it also drew regulatory scrutiny and law enforcement attention due to concerns surrounding illicit activities. This intensified focus on combating crypto-related crimes has inadvertently diverted attention from the transformative power of blockchain technology itself and its applications in various industries

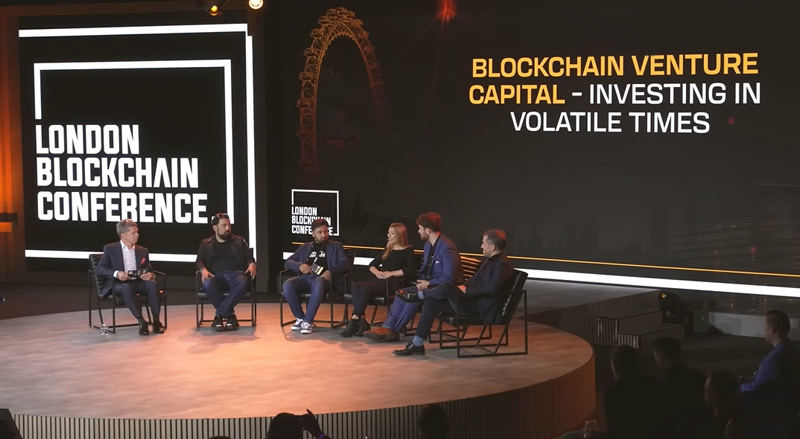

This was a key panel discussion at the recent London Blockchain Conference, which was hosted by Paul Rajchgod, Managing Director of Ayre Ventures. The other panellists included:

- Ray Sharma (Founder of Extreme Venture Partners);

- Farid Haque (General Partner of Systema Nova);

- Mona Tiesler (Investor at Tokentus Investment AG);

- Zach Resnick (Co-Founder of Unbounded Capital);

- Dr Patrick Sutter (Co-Founder of SNGLR).

Different perspectives on investing

Tiesler began the discussion by noting that Tokentus Investment’s shares are publicly traded in Germany, allowing individuals to purchase them. She added that the company strives to foster symbiosis throughout its entire stakeholder network.

One investment she highlighted was Transak, a portfolio company of Tokentus. Transak serves as a fiat on-/off-ramp, facilitating transactions with over 160 tokens and 75+ blockchains. It plays a crucial role in assisting customers from over 150 countries in transitioning from Web2 to Web3. Tiesler emphasised Transak as a tangible real-world use case that contributes to onboarding individuals into the space, fostering the growth of the industry.

By comparison, Haque, emphasises his team’s focus on B2B applications, specifically targeting solutions that enhance business efficiency, speed, and cost-effectiveness. Haque advised founders to emphasise these advantages in their pitch deck, considering it a compelling “call to action” for any venture capitalist intrigued by the potential of achieving 10x cost savings and 20x faster operations.

Haque’s firm adopts a market-first approach, inspired by the strategy of the renowned tech VC figure Don Valentine, who prioritised investments in very large markets. According to Haque, market size is a significant factor influencing their decisions.

An increased focus on developing markets

Sharma discussed his company’s keen interest in Africa, particularly in Nigeria, with future expansion plans in Egypt, Kenya, and South Africa. He highlighted that approximately 80% of startup activity in Africa is in fintech, driven by the fact that 50% of mobile transactions on the planet happen on the continent.

He drew a parallel between Africa’s innovation trend and China’s evolution in messaging apps, emphasising the continent’s potential for rapid advancement. However, he cautioned against overselling blockchain’s transformative potential, noting that while it offers undeniable benefits, it’s just one aspect among many in the checklist of solutions companies consider, perhaps one of 10, rather than a magic bullet for all challenges.