Centi is a Swiss startup working on payment and tokenisation solutions via the BSV blockchain. Centi has just released its beta app, which you can download and try out at centi.ch/app.

Centi uses the BSV blockchain to implement one of the most pertinent use cases of the BSV blockchain: the replacement of legacy payment systems with faster, cheaper and more secure payment solutions with the BSV blockchain or its own tokenisation solutions.

Some of the ideas for this have been around for a while, and yet these have only recently become practical thanks to the BSV blockchain.

‘The idea for founding Centi was a mixture of fascination for fast, truly digital payments and analysis of needs in the payment industry. Some of the ideas for this were older, but in 2015 to 2017 there was simply no thought of implementing them. With BSV we saw our chance and grabbed it.’

Location Switzerland – an ideal location for blockchain innovation

Initially, Centi will focus on Switzerland. Switzerland is an ideal location for the use cases that Centi is working on. According to Swiss tax regulations, payment services in digital currencies are treated in the same way as transactions in foreign currencies – they are exempt from VAT. Digital currencies are also not considered securities. This means that certain tokens and coins can serve as the ‘grease in the gears’ of blockchain onboarding, as Müller puts it.

From the application areas in Switzerland, however, Centi also wants to scale to other sectors in the rest of the DACH region and Europe-wide. Let’s take a look at two of Centi’s primary use cases.

An innovative solution to high drop-out rates at the paywall

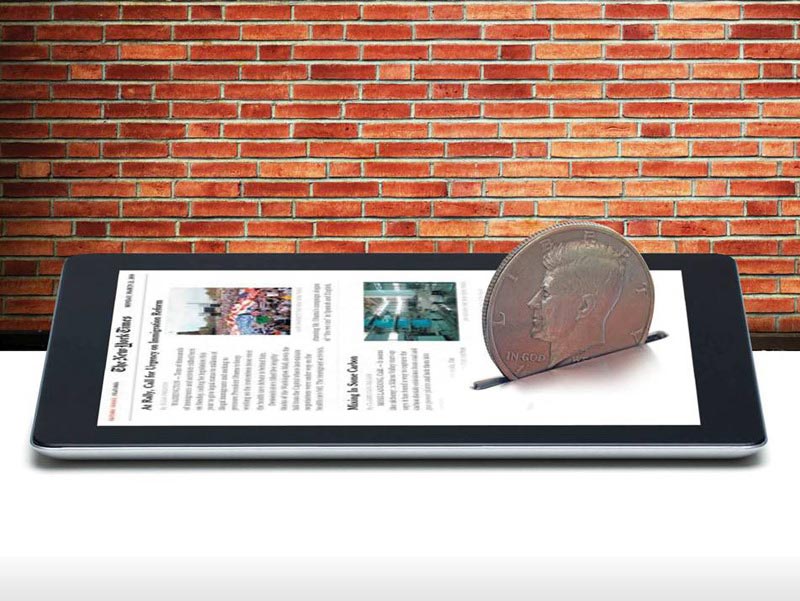

Traditional media such as newspapers and publishers have still not found the perfect solution for online payment processes since the dawn of the Internet. Certain apps or services such as Google News can show a user content for very specific interests, which is often hidden behind a paywall.

Readers are often only interested in a specific article and consider a long-term subscription to be superfluous. A study in the Journal of Marketing, Paywalls: Monetising Online Content, shows that many engagement metrics plummet after implementing a paywall:

Nevertheless, the study shows that monetising content can be worthwhile for publishers.

Centi offers publishers new monetisation options by allowing payments for a single article in addition to the traditional subscription model. A simple solution that cannot be solved with previous legacy systems.

As things stand today, payments of small amounts or micro-payments are inefficient. The effort for a single user to enter credit card data for a single item seems disproportionately high. Such micropayments are also only worthwhile to a limited extent for publishers, since credit card payments, for example, incur fees that are also too high for small amounts. In addition, many users do not want to enter sensitive data such as credit card details for individual items and do not want to go through the check-out process.

Free trial subscriptions are traps that you can quickly get caught up in. Many consumers have had correspondingly negative experiences, which is why the drop-out rates for paywalls are very high overall. The implementation of such paywalls can therefore even harm some media and publishers if conversion rates are low and they do not replace valuable traffic.

Centi offers a blockchain-based solution that addresses all the weaknesses of the previous payment system. From the user perspective, the system works via a Paymail address. No sensitive data is stored during the payment process, since a user remains pseudonymous via the paymail address.

Once installed, a user can complete the payment process with just a few clicks. The Centi app thus lives up to the instant gratification principle, a driving factor for the success of globally popular apps such as Instagram or Tiktok.

Centi’s simple, almost instant solution opens up a new customer channel for publishers. If readers decide to buy articles of a certain online medium more often, they will also be presented with interesting offers (loyalty points, discount vouchers, coupons, etc.), which can also lead to subscriptions.

Event industry after the pandemic: solutions for old pain points

In the events industry, business can finally get back to usual after the pandemic. For the most part, these events won’t be much different from pre-pandemic days. At the same time, industry innovations, mainly focused on certificates, have been introduced.

When it comes to on-site payments though, there is still a lot of need for innovation. For security reasons alone, there is always a desire to avoid excessive cash payments at festivals and events. As an alternative, organisers can currently choose between two solutions.

On the one hand, there is the possibility of renting payment terminals. However, organising them through an appropriate provider with leasing contracts is relatively complex. Once purchased, they are convenient for festival-goers to use, but less lucrative for organisers. Every single transaction incurs additional fees.

The alternative to this is a system that works via receipts or tickets. Although the system has established itself over other solutions, it is inflexible and ineffective in several respects. When entering a festival, visitors often encounter a long queue for the purchase of vouchers. This is particularly annoying when queues form as soon as you’ve entered the building. With Centi, this entire process is quickly and easily moved to the app.

The previous process is also often inflexible when sponsors, VIPs, helpers and crew members are to receive free services and food quickly and easily. Centi makes this easy to organise and customise for each event. The fees and the effort for the payment processes are also much cheaper and simpler by using your own token or stablecoin or by using digital vouchers. The accounting of the total income and that of the individual is simplified by Centi via an organiser dashboard.

This, in turn, is embedded in the larger area of data management – an area that the events industry still grossly neglects. Events typically have poor data collection, analysis, and remarketing. According to a study by Freeman, 88% of respondents have used event data for marketing and other purposes.

According to the same study, the lack of effective data analysis (46%) and access to complete and comprehensive event data (37%) are the top challenges in unlocking the full potential of data.

For the organisers, several pain points in customer experience, accounting and profit maximisation are addressed through the adoption of a service built on the BSV blockchain.