Did our recap of day one and day two of the BSV Global Blockchain Convention highlight specific presentations and panel discussions for you to catch up on?

In this edition, we offer you short summaries of day three’s content with links that direct you to the video content.

Convention opening

In his opening of the convention’s final day, Jimmy Nguyen, Founding President of the BSV Blockchain Association, reminded the audience of the Association’s mission: to build a world of good instead of one of speculative cryptocurrency investment, or one where blockchains fail to scale and deliver any utility to the world, or a world of darkness where blockchain and cryptocurrency assets are associated with illicit activity.

The power of BSV is to finally unleash the scaling of the Bitcoin protocol to create an efficient peer-to-peer electronic cash system to solve the problem of how the Internet protocol failed at how to send money, or value, natively through the Internet.

This creates a powerful distributed data network where information, data, your identity, government and business records can be accessible and verifiable to all – to create a world of more efficiency and honesty.

Law and order: Regulatory compliance for blockchain

Moderator – Marcin Zarakowski, General Counsel & Chief of Staff, BSV Blockchain Association

Panellists:

- Angus Brown, Founder & CEO, Centbee

- Seamus Andrew, Founder & Managing Partner, Velitor Law

- Dominique Lecocq, Founder & Managing Partner, lecocqassociate

- Rafael Schultz, CEO & Founder, Blockchain Punk Labs

_____________________________________

As someone from a legal background, Zarakowski was drawn to the blockchain space because of the legal conundrums it introduces. He asked the panellists to tell the audience what differentiates the regulatory frameworks of the jurisdictions they operate in.

Schultz referred to Germany’s reputation for making fast cars to point out that they’re similarly quick with digital asset regulation and a crypto-friendly regulatory framework (although they are usually slow on digitalisation.)

When it comes to Switzerland, Lecocq mentioned that they have approached the different aspects of the blockchain space – regulatory, tax and corporate law – in different ways. In the regulatory aspect, Switzerland was quick to define the different types of tokens, while corporate law and taxation took a bit longer.

In terms of the UAE, he said that the Free Zones were fast in adopting blockchain rules, with Abu Dhabi being the first to issue legislation.

Andrew said that he thinks of London as a place that’s moving in the right direction in terms of blockchain regulation, comparing it to the USA where the regulatory framework is difficult to navigate due to the differing approaches of different states and different regulators.

Although Brown’s blockchain payments business is domiciled in South Africa, it services customers in 186 countries. South Africa looks at cryptocurrency from two perspectives; as a payment instrument and as an asset. In each case, the relevant existing legal frameworks apply, although the policy for digital is still in the pipeline.

Tokenising assets and securities on blockchain

Moderator – Naeem Aslam, Columnist, Nasdaq | Founder, Zaye Consulting

Panellists:

- James Belding, Co-Founder & CEO, Tokenized

- Daniel Lipshitz, CEO, Gap600 and Change Digital Commerce

- Antonino (Nino) Sardegno, Managing Partner, Hummingbird Capital Partners Ltd.

- Stas Trock, BSV Script Engineer

Trock said he decided to choose BSV as his platform of choice as other crypto assets had run into issues with scalability, security and double-spend. By comparison, he noted that BSV offers both security and scalability – and is the crypto asset still based on Satoshi’s Vision.

These benefits were also highlighted by Sardegno, but he noted that his firm is specifically focused on Enterprise-grade features including ‘low costs at high volumes’ and tokenization – which is offered by BSV.

Daniel Lipshitz said he believes that BSV’s route to major adoption is through tokenization and data services. Similarly, he noted that tokenization’s route to mass adoption will be through BSV. The fact that BSV is the original Bitcoin design, and is unpinned by strong infrastructure, means it can scale rapidly on other chains using BTC very easily – which is a critical network advantage that is overlooked.

He added that the simplicity and easy programmability of BSV is now ‘filtering through’ and will start having a massive impact on the market.

Belding said Tokenized opted to use BSV as a platform due to its public ledger and the immutable timestamp record which makes it immune to traditional risks. However, he noted that the ‘real value’ of BSV is unlocked at the application layer – beyond tokens – with contracts. He pointed specifically to the private capital market where there is little digitalisation being used and contracts are typically not standardised. Belding said BSV and tokenisation allow these contracts to be structured and codified, providing huge opportunities in this space.

Sardegno said his firm is also highly focused on private equity and alternative investments. This includes looking to move past traditional legacy systems and potentially leapfrogging them by offering a token instead of a piece of paper.

_____________________________________

Islamic finance and blockchain

Panellists:

- Dr Farrukh Habib, Co-Founder, Shariah Experts & Alif Technologies

- Khalid Howladar, Chairman, MRHB DeFi | Partner, Acreditus | Senior Managing Director & Head of Credit & Sukuk, R.J. Fleming & Co.

- Zahid Mir, CEO & Co-Founder, Halalverse & VOSTAD

- Muhammad Zubair Mughal, Managing Director, AlHuda Centre of Islamic Banking and Economics

Mughal said that Islamic finance differs from traditional finance in that it focuses on those elements which are permissible in Islam, including payments and lending free of interest. He added that there are other un-Islamic elements which are not permitted, such as gambling. With Islamic Banking seeing rapid growth in recent years, Mughal expects fintech, cryptocurrencies, NFT and blockchain to form a key pillar of Islamic banking going forward.

Mir added that while there have been many halal financial projects, many of these do not have the necessary in-house Sharia experts. He noted that this was a major untapped market, with the Islamic population and banking system one of the largest in the world. However, the expert panel also acknowledged that the system is open to abuse, with investors hit by the double-blow of fraudulent crypto asset schemes which prey on people’s Islamic faith by pretending to be halal.

Howladar said that while a halal offering is important, it’s not as important as offering a good product, utility, value, marketing and a good team. He said that there is a specific niche for BSV and blockchain technology outside the traditional banking system to offer more ‘sincere’ Islamic banking offerings – including tangible business financing. Blockchain allows for a decentralised peer-to-peer system, with settlement, to offer a ‘new version’ of Islamic finance.

Habib said traditional Islamic financial institutions, such as banks, are typically hesitant on crypto assets but not blockchain technology. There is also a broader concern about what a decentralised and democratised system will do to the financial system, he said. He added that blockchain and crypto assets are a much better match for Islamic finance compared to the current banking system, as they provide perfect transparency and auditability.

Mughal said several elements need to be met for a crypto asset to be considered sharia-compliant. Mir’s Halalverse project plans to assist this by filtering out projects which are halal-compliant and highlighting projects which are making an ESG impact.

Howladar added that blockchain technology is inherently neutral, but it’s ultimately what is done with it that matters. Habib said this extends to the metaverse and gaming, with there a definite possibility of halal games being introduced.

_____________________________________

Smart contracts and computation on BSV

sCrypt founder and CEO Xiaohui Liu started his presentation by pointing to the original Satoshi white paper and how Bitcoin was originally designed not only for payments but also for smart contracts, escrow transactions, third-party arbitration and multi-party signatures.

He added that other crypto assets face several issues with scalability and utility – including Schnorr signatures and Taproot – which are non-existent on BSV. Liu also detailed the technical features available on BSV which allow developers to make changes in minutes, with minimal coding required.

While other crypto assets constantly have to break and fork their platforms to implement these changes, Liu said BSV has been designed for smart contracts since the outset. This impressive versatility means developers even can run Ethereum on top of the BSV protocol, he said.

___________________________________

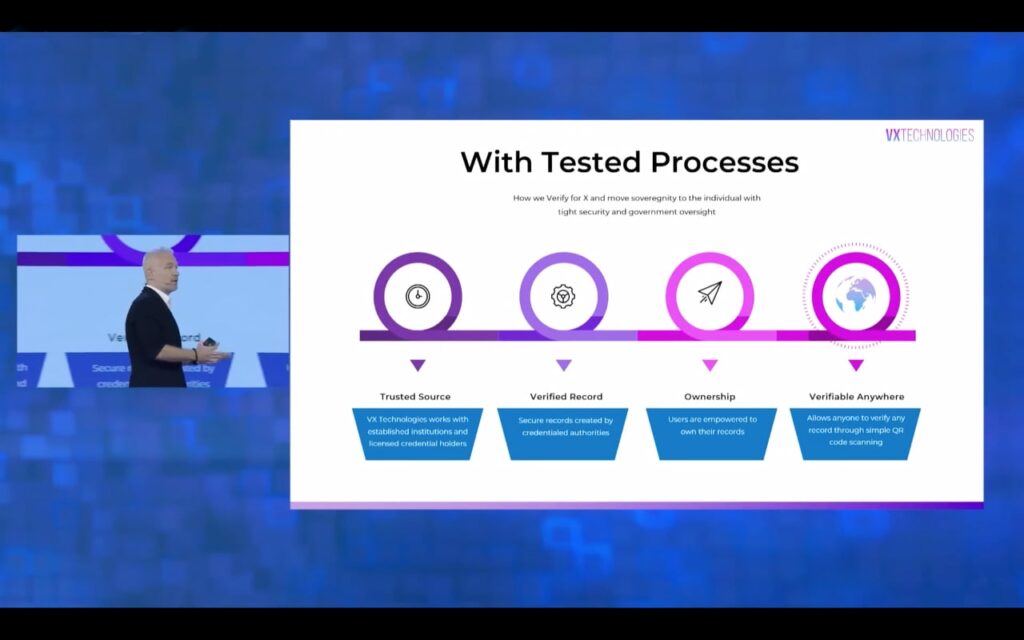

Trust but verify: everything

Justin Pauly, President and Co-Founder of VX Technologies introduced his company’s history by relating the story of how they solved the problem of verifying records to move sovereignty to the individual with tight security and government oversight.

Based on a core system of using BSV as a storage solution, VX Technologies has developed solutions for verifying credentials, achievements, health records or any other ‘X’.

BSV’s affordability lets them create an alternative to expensive cloud-based systems that leaves personal data vulnerable and open to manipulation and fails to keep data private.

Additionally, the fact that BSV data records contain no personally identifiable data allows them to provide high-quality data to universities, governments and research organisations, without compromising user privacy.

Blockchain in Africa

Moderator – Ahmed Yousif, Middle East Lead, BSV Blockchain for Government Initiative

Panellists:

- Kashifu Inuwa Abdullahi, Director General, National Information Technology Development Agency (NITDA) in Nigeria

- Jibril Aku, Group Vice Chairman, FMDQ Group | Chairman, Domineum Blockchain Solutions

- Dr Catherine Lephoto, Executive Sales Director, VX Technologies

- Reginald Tumusiime, CEO & Founder, CapitalSavvy

Abdullahi noted that Nigeria has a high literacy rate and high internet penetration rate, with the Nigerian government aiming to create an enabling environment to educate about BSV, blockchain technologies and other tech projects. This will include the establishment of a BSV Academy which aims to train one million developers in the country.

Aku noted that Africa remains a cost-sensitive region, and a large number of people simply do not have a bank account. This is where BSV will come in as it can offer financial services, at a fraction of the cost, to internet-savvy young Africans, he said.

Lephoto said Blockchain also can address some social ills facing Africa, including specific sectors such as healthcare. She provided the example of the ongoing covid pandemic and the possibility of including personal health and vaccination information on the blockchain.

Tumusiime said there are large funding gaps in part of Africa, with his group currently tackling issues around agriculture, payments and logistics. He reiterated that the continent’s young population is particularly keen to adopt new technologies – including BSV blockchain.

Abdullahi said that these young Africans are also typically uncertain about government bureaucracy and regulations, and BSV provides a secure platform which protects citizens and offers security in whatever is transacted. Any technology that lowers the cost of investment and reduces bottlenecks will be good for the continent, said Aku.

___________________________________

Blockchain in the Middle East and South Asia

Panellists:

- Salman Arain, Co-Founder, Funadiq.com | CEO & Co-Founder, Umrah Companions

- Arzish Azam, CEO, Ejad Labs

- Noman Azhar, Chief Digital Officer & Head of Zindigi, JS Bank

- Ralf Glabischnig, Founder, Crypto Oasis

- Ali Shobokoshi, CEO & Co-founder, Salis

Azhar said his company aims to use the BSV blockchain to digitalise several key services, including education and connecting the blockchain startup sector with the traditional banking sector.

Azam said the future is bright for crypto assets, especially in Pakistan, with citizens heavily investing in the technology – despite no major regulations being in place.

Arain said travel is one of the best use cases for blockchain technology, citing the Muslim pilgrimage and the more than 10 million people who travel to Saudi Arabia every year. This extends more broadly to the tourism industry, which requires a lot of transparency, the integrity of information and many transactions, he said.

Shobokoshi said Saudi Arabia is historically conservative when it comes to new technologies, especially those dealing with money. However, he noted the country is still eager to innovate and be at the forefront of blockchain, with several events and accelerators planned in the country.

Glabischnig said that while countries such as Dubai have the capital, talent and infrastructure to help grow BSV and blockchain technology, more can be done to improve the regulatory infrastructure and codify the system. He added international capital is increasingly flowing into the Middle East, and Dubai in particular, and is set to be the ‘centre of the blockchain universe’ in the coming years.

Azhar added that Pakistan is also well positioned for the coming wave of blockchain investment and development. He added that his team is working with government regulators to show the benefits of blockchain technology, with a regulatory framework in development. This was echoed by Azam who noted that there are several simple use cases for Blockchain technology in Pakistan, including university degrees, ID cards, passports and other certifications.

_____________________________________

Build on blockchain: common challenges and tools to make it easier

Moderator – Kurt Wuckert Jr, Chief Bitcoin Historian, CoinGeek | Founder, GorillaPool

Panellists:

- Marcin Rzetecki, Technical Outreach Specialist for Central Europe, BSV Blockchain Association

- Rami El Sabeh, IT Operations & QA Lead, Midis Group

- Rohan Sharan, Founder, TimeChain Labs | BSV Blockchain Association Ambassador for India

- Shameer Thaha, CEO (EMEA) & Global Chief Strategy Officer, Accubits Technologies

Starting off the presentation, Rzetecki said that one of the biggest challenges around developing on the blockchain is education and a lack of good blockchain experts on the market. This was echoed by Thaha who noted that there was often a misunderstanding from companies about what blockchain technologies should be used for and how they can be incorporated into their enterprises. In addition to talent availability issues, Thaha said the industry was also facing questions around scalability and interacting with legacy government and finance systems.

Sharan said BSV is at an advantage in this regard, as developers have built tools to easily interact with the platform and increase its interoperability with other systems. Rzetecki said this was the exact reason why he opted to use BSV over other platforms, as it offers unparalleled scalability. He added that more should be done to educate people and show that this is a solution that works.

Speaking specifically on how blockchain technology can be used in Dubai, El Sabeh said the construction industry was a largely untapped market, with the technology allowing for the digitalisation of workflows, management and health and safety records. He added that a public blockchain is one of the key ways that all industries in the region can deal with client-side issues.

Thaha said that the establishment of a regulatory body will help with the adoption of Bitcoin as it reduces the friction in selecting a specific platform and would allow a consortium of departments and businesses to work on a single chain.

Sharan added that one of the most difficult parts of development is determining which parts of the transactions remain on the blockchain over the long term. The panellists noted that some of the developments which are needed include connections to other chains, fiat currency solutions and interoperability between wallets.

_____________________________________

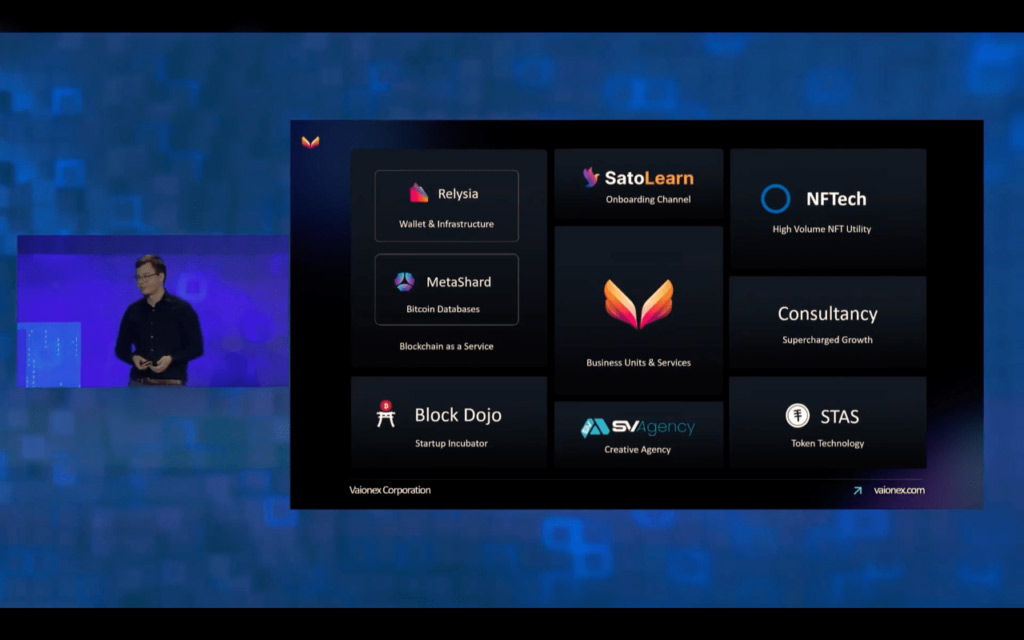

Vaionex: Frictionless blockchain solutions

Robin Kohze, CEO and Co-Founder of Vaionex Corporation introduced his company’s frictionless blockchain services as a path for enterprises to gain access to blockchain’s indisputable data records thanks to BSV’s scalability and affordability.

But, beyond BSV’s incredible infrastructure, for adoption to take place, there’s the need for libraries and tools that programmers can work with, consulting businesses and services that companies can rely on as well as education.

Marketing, loyalty programmes and blockchain

Moderator – Martin Coxall, Head of Marketing, BSV Blockchain Association

Panellists:

- Chad Anderson. President, Oceanside Digital Assets

- Joe DePinto, Co-Founder & CMO, Haste

- Phuong Dinh, Chief Strategy & Purpose Officer, Mijem Inc.

- Luke Rohenaz, Co-Founder & CEO, TonicPow

Rohenaz said one of the biggest use cases for blockchain technology is social media, with a sea change on the horizon where users are not targeted by advertisers and have their personal data sold.

This was echoed by Dinh, who said that Mijem opted to use the BSV Blockchain due to its scalability and ability to provide a large public ledger which keeps customers’ personal information safe. He added that once more people adopt BSV, its functionality will increase beyond just payments into services and other blockchain-related applications. Because blockchain is immutable and safe, it also promotes much stronger loyalty from customers as they don’t have to worry about losing their account and earnings or points, he said.

Anderson said BSV Blockchain facilitates ‘proof of attendance’ features, allowing event organisers to scan an attendee’s NFT when entering a venue and giving out rewards and prizes. He added that the technology is a perfect fit for loyalty programmes and play-to-earn games.

DePinto said BSV Blockchain provides to ability to use micropayments to incentivise customers to promote businesses. He provided the example of customers being given a micropayment for giving a positive review at a restaurant. This extends to games, social media and other industries, where the blockchain allows businesses to ‘gamify’ interactions and incentivise users to return, he said.

_____________________________________

ESG compliance and blockchain

Moderator – Sean Griffin, Director of Communications & Corporate Development, nChain

Panellists:

- Brian de Clare, CEO, Ackareen Inc.

- Thomas Giacomo, Head of Product Development, TAAL Distributed Information Technologies

- Dr Andrew Parker. EVP, Hydrocarbons & Sustainability, SPL

- Kevin Stover, CEO, Sand Dollar Ventures

De Clare started the presentation by noting that there has been a significant shift in capital away from the fossil fuel sector to the clean-tech sector in recent years. The blockchain will assist in this regard by tracking carbon emissions and monitoring emissions from a regulatory point of view.

Stover said that there had been a sea change in recent years as executives are increasingly looking to meet their ESG goals using new technologies. While there is some hesitancy in adopting new tools, such as the blockchain, he noted that there has been a clear uptick in people wanting to learn about the technology and innovate using it.

Giacomo said that the blockchain will bring some standardisation to this process, He provided an example of a company exchanging their greenhouse gas emissions with an energy certificate on the blockchain alongside some credit, with smart contracts allowing these transactions to take place in a decentralised way. He noted that several governments are working to change their ESG systems to be based on blockchain.

Dr Parker added that the logical application for blockchain technology in the energy sector right now is tracking carbon-credit swapping, and managing this data. He added that much of the ESG sector right now is subjective, and the blockchain will allow for more standardisation, with BSV Blockchain’s scaling allowing for more qualitative analysis.

_____________________________________

Blockchain mining and energy innovation

Moderator – Patrick Thompson, Associate Editor, CoinGeek North America

Panellists

- Richard Baker, CEO & Director, TAAL Distributed Information Technologies

- Alex DeVries, Founder, Digiconomist

- Prof. Robert Lee, Founder, International Digital Economy & Blockchain DBA Project | Founder, 518 Blockchain Community

- Kurt Wuckert Jr, Chief Bitcoin Historian, CoinGeek | Founder, GorillaPool

All crypto assets that can be mined together currently consume at least as much energy as the world’s data centres – or about 1% of all electricity consumption, said De Vries. Baker said that this usage is problematic as policymakers look at crypto assets as being highly consumptive and demanded.

As the world faces an energy crisis, there are questions about whether regulators will ban proof-of-work. Baker said BSV blockchain differs in that it is utility proof-of-work and offers its own value.

Prof Lee said depending on how and why energy is used, crypto assets and blockchain technology could be either a net negative or a negative positive. He noted that it was possible to continue with proof-of-work under regulations and using green energy. He added that certain mining machines are seen as more environmentally-friendly than others.

Wuckert Jr. added that the proof-of-stake has major economic issues in that it is essentially a ‘pyramid scheme’ and makes it less trustworthy compared to a proof-of-work and offers the most over the long-term. He noted that it was possible to use the excess heat and energy in unique ways, including power greenhouses and heating swimming pools.

Baker said most miners are setting up in North America, with states like Texas, Georgia and Kentucky seen as particularly ‘friendly’. However, he cautioned that the mining industry is going to increasingly become subject to ESG reporting and it’s now up to operations to ensure that they comply.

_____________________________________

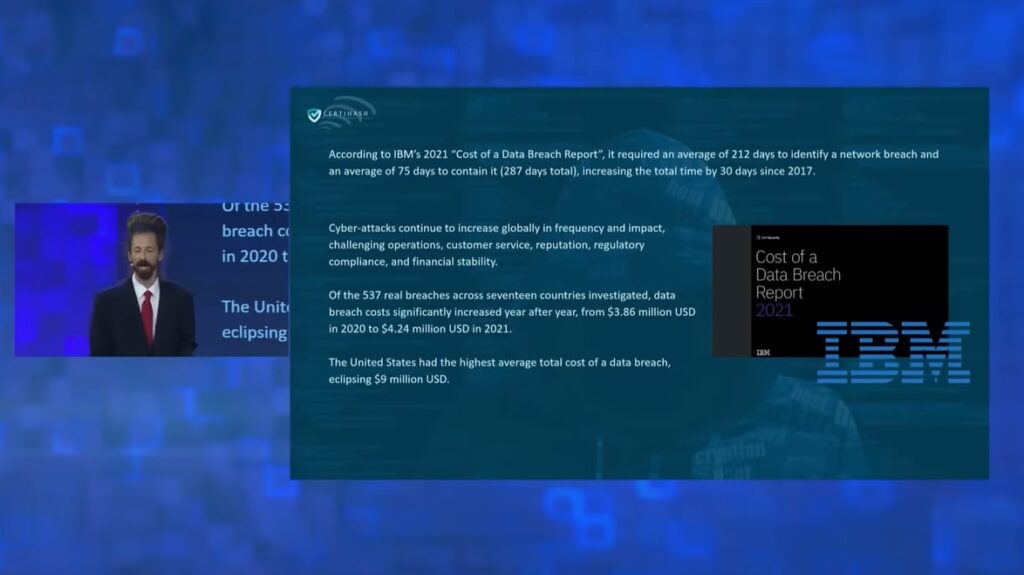

Sentinel Node: Blockchain tools to improve cybersecurity

Certihash’s Gregory Ward took the stage with Patryk Walaszczyk from IBM Consulting to talk about Sentinel Node, a new suite of tools being developed on the BSV blockchain to improve cybersecurity. Ward describes Sentinel Node as a “next-generation cybersecurity detection tool” that can make data breach detection near-instant.

While IBM estimates that it currently takes nearly 212 days to identify breaches, Ward said Sentinel Node can make detection near-instant due to the power of the BSV blockchain. This is because it focuses on key features, intrinsically tied to BSV’s functionality, including the ability to detect every network entrance, file change, or log change and place records of these on the immutable blockchain.

This will allow organizations to continuously compare their records with an unchangeable on the blockchain, immediately recognizing when there’s a data breach or even a modification of a file, he said.

Walaszczyk said that BSV is the right technology choice for enterprises due to its low costs, scaling potential, and security features. He added that IBM plans to continue working with BSV and Sentinel Node over the long term and now plans to go live with the product to assess market adoption.

_____________________________________

Cybersecurity: a safer world with blockchain

Moderator – Jimmy Nguyen, Founding President of the BSV Blockchain Association

Panellists

- Malak Trabelsi Loeb, Chair of Medusa Cysec

- Jorge Sebastiao, Co-Founder of Global Blockchain Organization and EcoX

- Patryk Walaszczyk, Blockchain Solution Expert at IBM Consulting

- Gregory Ward, Chief Development Officer of SmartLedger and Co-Founder of Certihash

Sebastiao said BSV Blockchain brings several additions to the cybersecurity space, as it offers a more dynamic platform. He noted that while the blockchain is immutable and secure, the applications interacting with it are not necessarily safe and hackers will often attack this vulnerability.

Walaszczyk said blockchain is unique in that it is already a technology that works beyond the ‘academic’ with real use cases already being implemented in sectors such as satellite security. By decentralising the security process, he noted that systems are far less vulnerable to a single administrator who could be compromised.

Ward said that three of the most important tenets of cybersecurity are confidentiality, availability and security – all of which are offered by the BSV blockchain. With the robustness of the blockchain and a guaranteed source of truth, there is no chance of a DNS or redirect attack impacting users as it can detect an incorrect domain.

Loeb said that decentralisation also offers protection from geopolitical issues, such as the ongoing supply chain crisis. She added that blockchain can protect both national and international interests.

_________________________________

Keynote: Cloud security, overlays and blockchain

In his keynote speech Bitcoin creator, Dr Craig S. Wright introduced the idea of Bitcoin as a base layer for other blockchains – a model of growth expansion that appears to be the best path of adoption for BSV blockchain as blockchains like Ethereum already have developed communities and tools created that support their ecosystem.

He noted that the BSV blockchain is scalable enough to process more transactions than another blockchain then could it just run a second blockchain internally effectively taking it over. This has the double advantage of keeping all the valuable features of the BSV blockchain, while users can continue using the apps they are familiar with on a second blockchain.

_____________________________________

The future world with blockchain

Moderator – Jimmy Nguyen, Founding President of the BSV Blockchain Association

Panellists

- Somi Arian, CEO and founder of FemPeak

- Latif Ladid, IPv6 Forum Founder

- Quirze Salomó, CEO of Blockchain Center of Catalonia

- Dr Craig S. Wright, Bitcoin creator

- Dr Usman Gambo Abdullahi, Director of IT Infrastructure Solutions

When Dr Wright created Bitcoin he envisaged a more honest world. He added that the technology allows customers to buy local and possibly minimise the ‘brain drain’ that sees skilled workers leave for other parts of the world due to the setup of the current financial system.

Ladid said that the internet has for the longest time lacked a case for security, which is usually expensive and difficult to implement. He added that the introduction of blockchain in emerging countries provides the opportunity to ‘leapfrog’ the rest of the world and be at the forefront of innovation. However, he said that the education system needs to be updated so that students can learn about and grapple with these technologies at the university level.

Arian said blockchain gives women the opportunity to own things, save and make money. She added that money and ownership are historically synonymous with men, and that blockchain and digital wallets will help change this.

Salomó said the BSV blockchain also plays a role in the regulatory and governmental sphere as it will encourage more secure and anonymous voting. This was echoed by Abdullahi who noted that the Nigerian government identified blockchain as an anti-corruption and governance tool. It will also offer economic diversification, with there being a need to empower younger citizens towards employment.

_____________________________________

Convention close: A world of good

In his closing address, Jimmy Nguyen, Founding President of the BSV Blockchain Association, announced that the next BSV Global Blockchain Convention will be taking place in London in May 2023. Nguyen also asked attendees to be mindful of what they use the BSV Blockchain technology for and whether it is aimed at making the world a better place.

He pointed to his own family history and drew parallels to the unlimited potential of the BSV blockchain. ‘What kind of world do you want? Do you want a world of investment speculation and just worrying about coin price? Where technology does not scale and operates outside the law?’

Nguyen said this was possible through the BSV blockchain with its unlimited scalability, P2P microtransactions and unparalleled security. ‘I want to see a world of light powered by blockchain.’

Attend a BSV blockchain event near you

The Association for the BSV blockchain is the global industry organisation that supports the BSV blockchain. To see similar events in your geographic location, head over to our events page.