Centbee’s Minit Money project has been announced for inclusion into the South African government’s regulatory sandbox, opening the door for one of South Africa’s most innovative blockchain businesses to make its mark on digital asset regulation in the country.

The sandbox was set up by the Intergovernmental Fintech Working Group (IFWG), an organisation comprised of several South African regulators. Regulatory sandboxes like this are used to test new technologies or business models against existing and developing regulatory frameworks. It allows the chance for regulators to better understand emerging technologies, but it also provides companies with the opportunity to take an active role in the development of legislation and regulation which affects them and their business.

Centbee – and more than 50 other fintech firms – had applied for inclusion in the sandbox. Only six were ultimately accepted.

At a time when solutions of all type are being increasingly driven by blockchain technology, ventures like the IFWG sandbox – and the ability of companies like Centbee to participate – are both critical and mutually beneficial. The initiative demonstrates the benefits of a collaborative approach between regulators and innovators, puncturing the still-pervasive belief that regulation can only be a constraint on innovation.

‘One of the benefits of the ‘regulatory sandbox’ is the opportunity to engage deeply with key operational people working inside the regulators,’ says Angus Brown, CEO of Centbee.

‘Some of these people have not been exposed to crypto – so this is an opportunity to educate them and dispel the myths that still persist.’

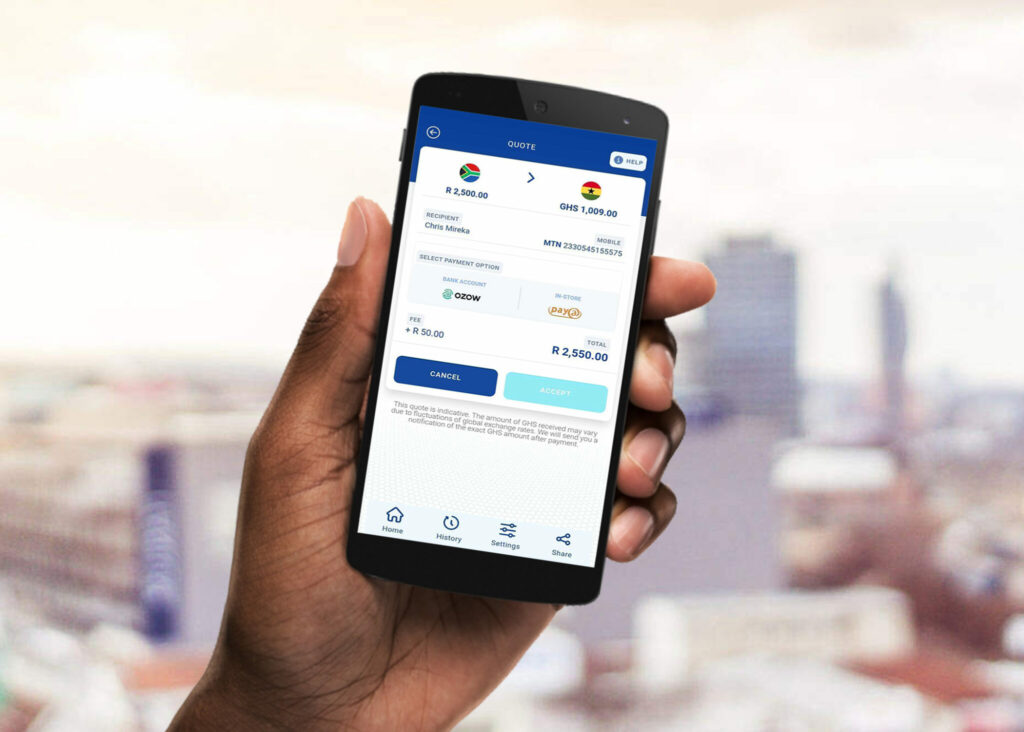

Centbee’s Minit Money product is the focus of the sandbox programme and is a product entrenched in improving financial inclusion. It facilitates cross-border remittances by using Bitcoin SV to enable minimal fees.

‘Sandbox programmes are a great opportunity to demonstrate to regulators how blockchain technology can provide fintech capabilities that benefit consumers – just like with Centbee – and still comply with regulatory requirements,’ explains Jimmy Nguyen, Founding President of Bitcoin Association.

‘We support all efforts for the digital asset industry to collaborate with and educate regulators about the broad set of use cases for blockchain technology beyond speculative investment tokens.’

In a country like South Africa, remittance services like that offered by Minit Money are essential financial infrastructure. South Africa is home to a significant population of migrant workers, many of whom send money back to family across Africa – making it important that the role these technologies play in the lives of vast swathes of the population are fully understood by regulators.

‘As the majority of crypto businesses are exchanges, the regulations globally have tended to focus on the treatment of Bitcoin as a financial asset class, with very little focus has been placed on Bitcoin as a payment mechanism,’ explains Brown.

‘Treating low-value payments – such as buying gaming vouchers or pizza – in the same way as making a large, speculative investment is clearly problematic, and we are working hard to persuade regulators to provide exclusions and appropriate thresholds to fully allow for Satoshi’s vision of digital cash.’

This is the type of insight that stands to be gained by IFWG when taking a collaborative approach to regulatory development. The fact that the IFWG is listening to the business community should go a long way to ensuring the ultimate regulatory framework which governs digital asset companies achieves regulatory goals without stifling innovation.

‘One of the difficulties that vanguard businesses in the blockchain space often run into is regulatory uncertainty, as innovation often far outpaces the ability of regulators to keep up with new technologies,’ explained Nguyen.

‘In the absence of a clear regulatory framework, companies can expose themselves to undue risk – oftentimes hindering progress. With regulatory sandboxes, businesses like Centbee get the opportunity to understand the perspective of the regulator and the perspective they are looking at these emerging technologies from. With a better understanding of the guiding principles of the regulatory, plus the opportunity to help develop the regulator’s understanding of largely nascent technologies, there are real positives to be gained from both sides.’

Innovative products and services such as those provided by Centbee can form a key pillar in growing the rates of financial inclusion within the country, which makes providing an environment where those products and services can be offered is important.

‘Being inside the “sandbox” has given us deeper insight into the true objectives of regulators. In many cases this is simply a desire to be able to measure the financial flows, to understand the impact on the sovereign’s GDP and balance of payments,’ adds Brown.

‘We have been providing them with detailed reporting, which we believe will enable them to publish reporting standards to crypto firms, which will enable the regulators to better manage the economy. We also find they are surprised by the seriousness with which we take Know-Your-Customer obligations, as they expect crypto firms to either not have this information, or to be advocates of pure anonymity.‘

Even leading up to their inclusion into the regulatory sandbox, Brown says that Centbee have maintained a good relationship with the IFWG.

‘We have had a good interaction with the IFWG since their formation. We have provided them with ongoing education about Bitcoin – both the risks and opportunities,’ he says.

‘The IFWG have been thorough in their desktop research into the technology and transparent in their interactions with the industry. In particular, they have followed a very consultative approach, with several iterations of position papers requesting comment and workshops with industry players including Centbee. They have clearly stated they encourage innovation and see potential in crypto assets.’

Now in the sandbox, those interactions should only become more frequent. Members of the sandbox are able to test new products against regulatory requirements in a closed environment – part of wider engagement between members and regulators. The role of the IFWG is more one of oversight, working with sandbox participants to build testing parameters

‘There are fortnightly meetings and frequent discussions which allow us to understand the specific objectives of each regulator and the systems they use to monitor financial institutions,’ says Brown.

‘This close engagement allows us to point out some unintended consequences of proposed regulations and to advise the regulators how they could perhaps adjust draft legislation to be both customer-friendly and less onerous on the crypto firms.’