Artificial intelligence is significantly transforming how businesses handle legal compliance and manage risks. By leveraging AI, organizations can:

● Boost Operational Efficiency

● Strengthen Compliance Measures

● Facilitate Predictive Risk Management

AI empowers companies to streamline their compliance processes, ensuring they stay ahead of regulatory changes and mitigate potential risks more effectively. Through advanced data analytics and automated systems, AI enhances the accuracy and speed of compliance operations, helping organizations maintain a robust legal posture and proactively address emerging risks.

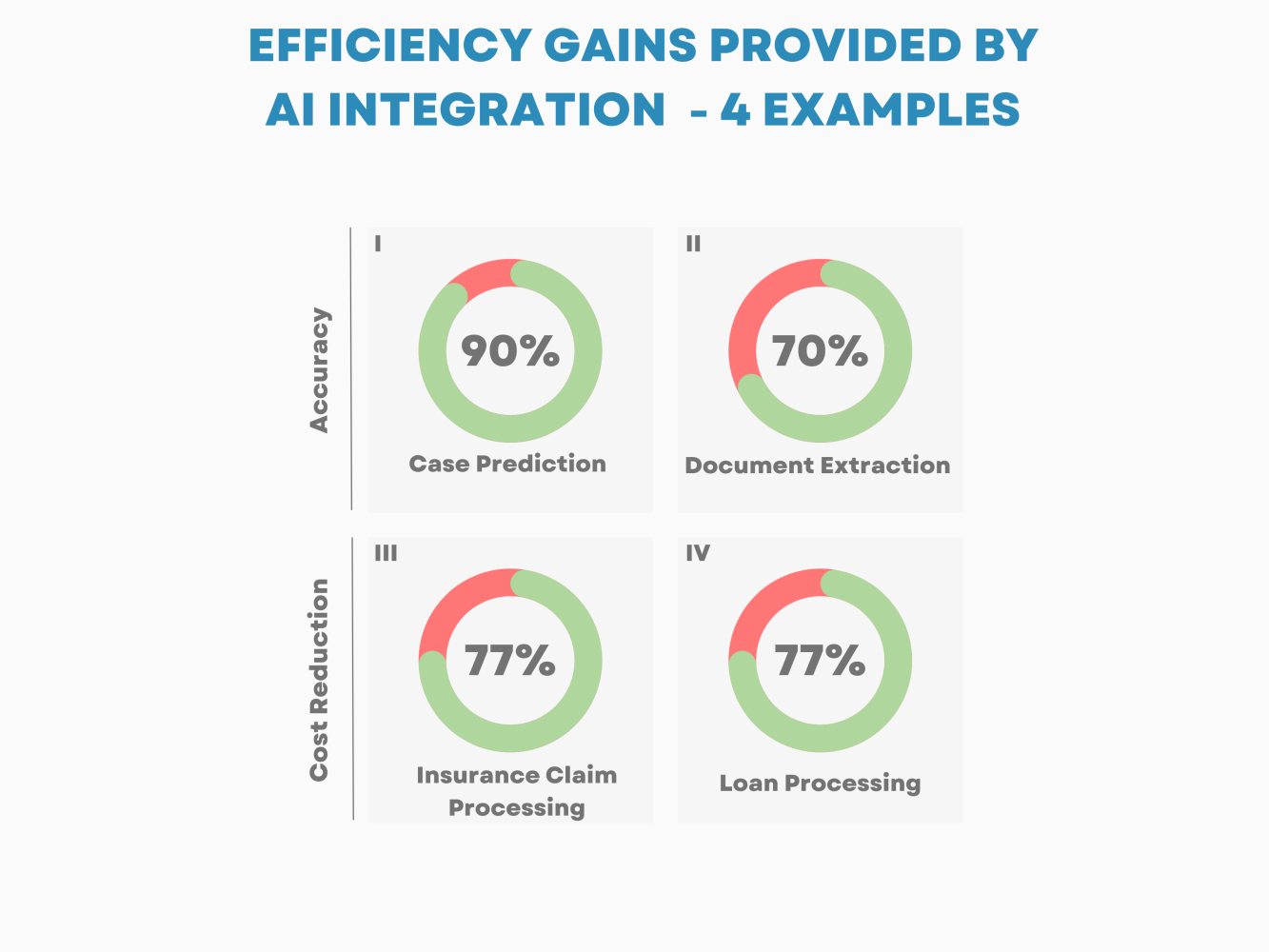

The infographic showcases significant efficiency gains achieved through AI integration across various sectors over the last years:

Case Prediction Accuracy: An AI-powered legal prediction engine developed by Toronto-based startup Blue J Legal Inc. focusing on tax law achieves 90% accuracy in predicting case outcomes, aiding legal professionals in decision-making.

Document Extraction in Insurance: A Nordic insurance company uses AI to reduce manual tasks, with 70% of documents correctly extracted and interpreted by the system, enhancing efficiency.

Insurance Claim Decision Making: An AI system automates insurance claim decisions, taking one-third less time than humans and reducing processing costs by 77%, speeding up claims processing and cutting costs.

Loan Processing and Underwriting: Touchless Lending by Tavant uses AI to reduce processing and underwriting costs by 77%, showcasing the substantial cost-saving benefits of AI in financial operations.

These examples highlight how AI enhances accuracy, efficiency, and cost-effectiveness in legal, insurance, and financial processes.

We are exploring additional transformative ways AI is revolutionizing legal compliance and risk management, focusing on the benefits and challenges associated with these advancements. As introduced in the first part of the series, we continue to delve into specific use cases where AI is making a significant impact, highlighting:

- How AI can bring substantial benefits.

- The unique challenges that need to be addressed.

Let’s dive into the second part of our series!

3. Mitigating Risks through Robotic Process Automation (RPA) in Compliance Procedures

Robotic Process Automation (RPA) is a technology that automates repetitive tasks and processes by simulating human interaction with digital systems. In compliance procedures, RPA can be applied to automate data entry, report generation, and other routine tasks, freeing up human resources for more complex and strategic activities.

Case Study Highlighting Benefits

A notable example of the benefits of RPA implementation in compliance procedures can be seen in a financial institution that utilized RPA to automate the collection and analysis of customer data for regulatory reporting. By implementing RPA, the institution achieved faster and more accurate compliance procedures while maintaining comprehensive audit trails to demonstrate adherence to regulations.

Benefits of RPA in Compliance Procedures

● Time and Cost Savings: By automating repetitive tasks, RPA reduces the time and effort required for manual completion, leading to significant cost savings for organizations.

● Improved Data Integrity: RPA minimizes the risk of manual errors associated with repetitive tasks, ensuring higher accuracy and consistency in compliance procedures.

Challenges of Implementing RPA in Compliance Procedures

● Managing Exceptions and Complex Workflows: While RPA excels at handling repetitive tasks, managing exceptions or non-standard scenarios may pose challenges that require human intervention or advanced decision-making capabilities. Organizations need to establish robust governance frameworks to address these challenges.

● Maintaining Control Over Automated Processes: Organizations need to ensure they have robust governance frameworks in place to monitor, evaluate, and maintain control over automated processes. This is crucial to ensure compliance with regulations and internal policies.

By leveraging RPA in compliance procedures, organizations can achieve greater operational efficiency and accuracy while mitigating risks associated with manual processes. Through the automation of routine tasks, RPA enables compliance teams to focus on higher-value activities that require human expertise and judgment.

To fully understand the benefits and challenges of RPA implementation in compliance procedures, it’s worth exploring articles such as “The Benefits and Challenges of RPA Implementation” and “Challenges Faced in RPA Implementations“.

4. Enabling Proactive Risk Management with Predictive Analytics

Predictive analytics and machine learning are crucial in helping organizations anticipate and mitigate future risks through data-driven insights. In the world of legal compliance and risk management, these AI techniques play a significant role in enabling proactive risk mitigation.

How Predictive Analytics Works in Risk Management

Predictive analytics in risk management involves using historical data and identifying patterns to create models that can forecast potential risks. This allows companies to take proactive measures to address these risks before they escalate into larger issues.

An Example of Predictive Models in Compliance Trends

One practical application of predictive models is in identifying emerging compliance trends. By analyzing large amounts of regulatory changes and past compliance data, companies can use predictive analytics to anticipate upcoming changes and adjust their compliance strategies accordingly.

The Benefits of Predictive Analytics for Risk Management

The use of predictive analytics offers several benefits for risk management:

● Early detection of potential risks: By identifying patterns and trends, predictive models can alert organizations to potential risks before they occur.

● Data-driven decision-making: With access to accurate insights, organizations can make informed decisions based on data rather than relying solely on intuition or past experiences.

● Staying ahead of compliance trends: Predictive analytics helps organizations stay updated with changing regulations and industry standards, allowing them to proactively adapt their processes.

Challenges in Implementing Predictive Analytics for Risk Management

While predictive analytics holds great promise, there are challenges that organizations may face when implementing it:

● Model transparency: In highly regulated industries, it is essential for organizations to be able to explain how their predictive models arrive at certain conclusions and predictions. This transparency is necessary to meet regulatory requirements and gain trust from stakeholders.

● Data quality and availability: Accurate predictions rely on high-quality data. Organizations must ensure that they have access to relevant and reliable data sources for their predictive models.

● Integration with existing systems: Implementing predictive analytics may require integrating new technologies or tools with existing systems, which can be complex and time-consuming.

By addressing these challenges and leveraging the power of predictive analytics, organizations can transition from reactive risk management practices to proactive risk mitigation strategies. This shift enables them to stay ahead of compliance requirements and make better decisions based on data-driven insights.