Artificial intelligence is revolutionizing the way businesses conduct due diligence investigations. By leveraging AI, organizations can:

● Enhance Information Retrieval

● Improve Data Analysis

● Accelerate Decision-Making

AI-powered tools streamline due diligence by efficiently handling large volumes of data, extracting relevant insights, and providing comprehensive risk assessments. This leads to faster, more accurate investigations, helping organizations maintain compliance and manage risks effectively. Through intelligent search algorithms and advanced analytics, AI enhances the due diligence process, ensuring thorough and timely evaluations.

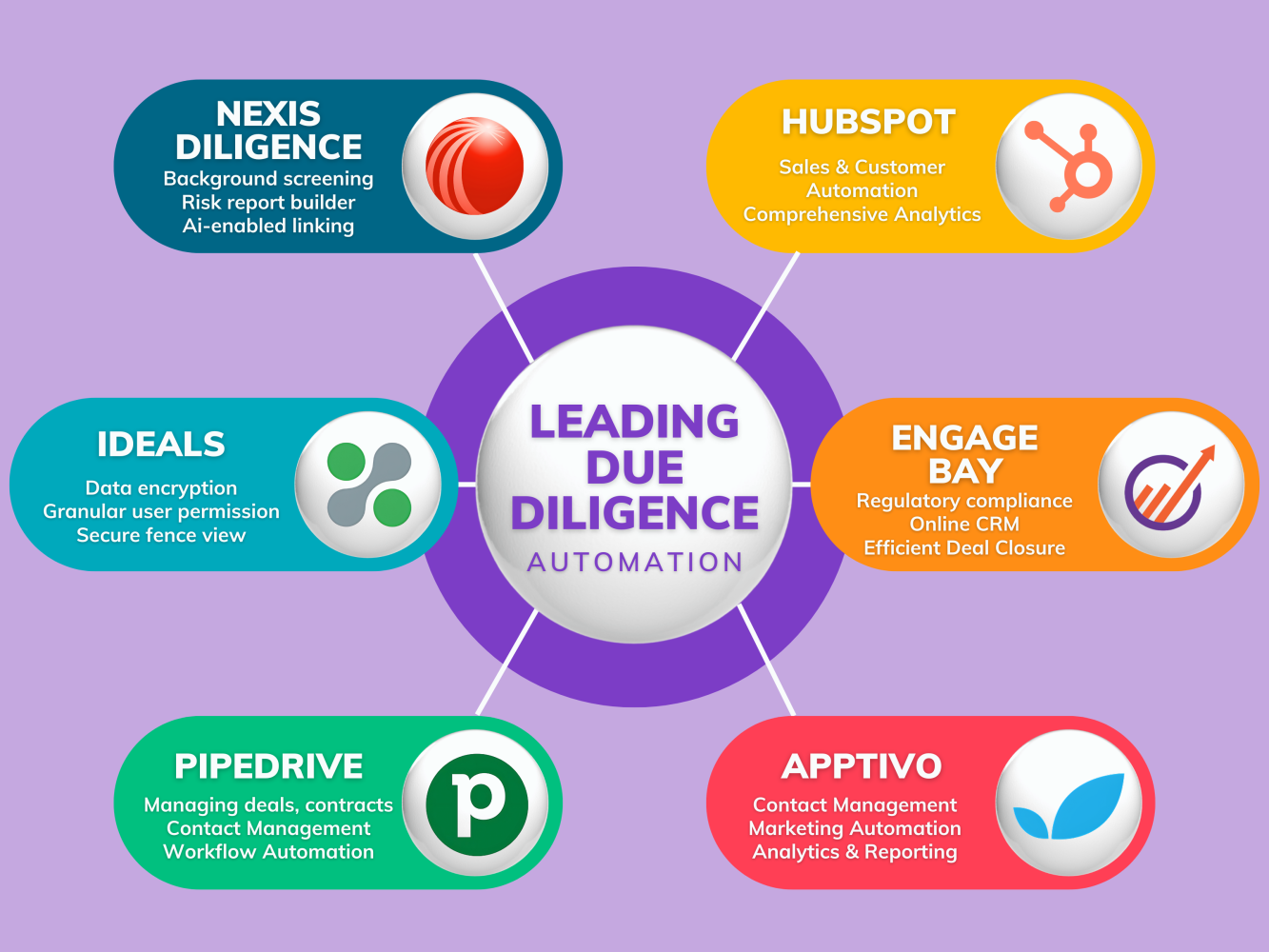

The infographic showcases significant efficiency gains achieved through AI integration across various sectors. AI-powered tools allow for comprehensive risk assessment and time efficiency by automating information retrieval and analysis, significantly reducing the time needed for due diligence investigations.

Nexis Diligence enhances due diligence with background screening, risk report building, and AI-enabled linking.

HubSpot offers sales and customer automation along with comprehensive analytics, making it a versatile tool for managing legal compliance. Rating: 4.5/5 on Capterra.

iDeals provides data encryption, granular user permissions, and secure fence views, ensuring the safety and integrity of your due diligence processes. Rating: 4.8/5 on Capterra.

EngageBay focuses on regulatory compliance, offering an online CRM and efficient deal closure capabilities. Rating: 4.7/5 on Capterra.

Pipedrive is designed for managing deals and contracts with features for contact management and workflow automation. Rating: 4.5/5 on Capterra.

Apptivo enhances contact management, marketing automation, and provides detailed analytics and reporting, making it a comprehensive due diligence tool. Rating: 4.4/5 on Capterra.

For a comprehensive overview of more state-of-the-art due diligence automation tools, check out the detailed list provided by Ravi Chachra, founder of 8vdx.

These examples highlight how AI enhances the accuracy, efficiency, and comprehensiveness of due diligence processes in legal, financial, and business environments.

We are exploring additional transformative ways AI is revolutionizing legal compliance and due diligence processes, highlighting the advantages and addressing the challenges these advancements bring. As introduced in the previous parts of the series, we continue to delve into specific use cases where AI is making a significant impact, highlighting:

- How AI can bring substantial benefits.

- The unique challenges that need to be addressed.

Let’s dive into the third part of our series!

5. Enhancing Due Diligence Investigations with Intelligent Search and Analysis Tools

In the world of legal compliance and risk management, due diligence investigations are vital for ensuring regulatory adherence and mitigating risks. With the help of AI-powered tools, this process has been greatly improved by making information retrieval and analysis during due diligence procedures more efficient.

How AI-powered Tools Improve Due Diligence

AI-powered tools use advanced search algorithms to make the retrieval and analysis of information needed for due diligence investigations faster and easier. These tools are designed to handle large amounts of data, including sources with no specific structure, and extract relevant insights to support regulatory compliance goals.

An Example of How AI-powered Tools Can Be Used

One example of how advanced search algorithms can be applied in due diligence is when they are used to speed up the investigation phase in a merger and acquisition (M&A) deal. By using AI-enabled intelligent search and analysis tools, companies can quickly find important information, evaluate associated risks, and make well-informed decisions within the limited timeframes typically involved in such transactions.

The Advantages of Using AI-powered Tools

The integration of AI-powered intelligent search and analysis tools into due diligence processes offers several benefits, including:

1. Comprehensive Risk Assessment: These tools allow for thorough analysis of different data sources, making it easier to assess potential risks related to business transactions or regulatory compliance requirements.

2. Time Efficiency: By automating the process of finding and analyzing information, AI-powered tools significantly reduce the time needed for conducting due diligence investigations, making decision-making faster.

Efficiency Gains Achieved Through AI Integration

As an example, Dili.ai stands out with its AI-driven platform specifically designed for private equity and venture capital firms. It automates the due diligence process by using advanced algorithms to handle key investment and portfolio management steps. This includes automating data collection, performing comprehensive risk assessments, and generating detailed reports. Dili.ai focuses on improving efficiency and accuracy in evaluating potential investments, reducing the time and effort traditionally required in due diligence investigations. Learn more at TechCrunch.

Moody’s due diligence services offer comprehensive solutions for Know Your Customer (KYC) and anti-money laundering (AML) compliance. Utilizing advanced analytics and extensive data resources, Moody’s provides thorough risk assessments, background checks, and continuous monitoring to ensure regulatory compliance and mitigate risks. Their tools help organizations streamline due diligence processes, enhancing accuracy and efficiency in evaluating potential business relationships and transactions.

The Challenges Faced with AI-powered Tools

While there are clear advantages to using AI-powered tools for due diligence investigations, there are also some challenges that come with them:

1. Handling Unstructured Data Sources: Dealing with data sources that don’t have a specific format can make it difficult to extract relevant information accurately and effectively.

2. Ensuring Quality Control in Automated Extraction: Making sure that data extraction processes are accurate and reliable is still a challenge, especially when relying on automated algorithms to retrieve and analyze information.

The adoption of AI-powered intelligent search and analysis tools has revolutionized due diligence investigations by making them more efficient, enabling comprehensive risk assessment, and addressing time constraints that are often present in important business transactions. However, organizations need to find ways to overcome the challenges related to unstructured data sources and maintain high standards of quality control in order to make the most out of these tools.

6. Using Natural Language Processing for Accurate Regulatory Reporting

Natural Language Processing (NLP) is a branch of AI that focuses on the interaction between computers and human language. In the context of legal compliance and risk management, NLP can play a crucial role in ensuring the accuracy and completeness of regulatory reports through semantic analysis and validation checks.

How NLP Can Improve Regulatory Reporting

By using NLP algorithms, organizations can:

1. Automate the generation of financial disclosures in compliance with accounting standards.

2. Reduce the time and effort required for manual report preparation.

3. Minimize the risk of errors in regulatory reports.

4. Enhance data integrity.

One case study that showcases the power of NLP in regulatory reporting is the automation of financial disclosure processes. Traditionally, financial reports involve extracting relevant information from various sources and compiling it into a standardized format. This process is not only time-consuming but also prone to errors due to human involvement.

However, by using NLP algorithms, organizations can automate the extraction and validation of financial data from unstructured sources such as annual reports, press releases, and news articles. These algorithms can understand the context of the text, identify key information, and validate it against predefined rules or templates.

The Benefits of Using NLP for Regulatory Reporting

The benefits of using NLP for accurate regulatory reporting are significant:

1. Error reduction: NLP algorithms are designed to handle complex language patterns and interpret context accurately. By automating the reporting process, organizations can minimize human errors that may occur during manual data entry or interpretation.

2. Enhanced data integrity: NLP algorithms can perform validation checks on extracted data to ensure its accuracy and completeness. By flagging inconsistencies or missing information, organizations can maintain high-quality data for regulatory reporting purposes.

The Challenges of Using NLP for Regulatory Reporting

However, there are also challenges associated with leveraging NLP for accurate regulatory reporting:

1. Handling diverse language patterns: Different jurisdictions may have unique reporting requirements and language conventions. NLP algorithms need to be trained on a wide range of language patterns to accurately extract information across different contexts.

2. Interpreting context accurately: NLP algorithms rely on machine learning techniques to understand and interpret the context of the text. However, there may be instances where the algorithms struggle to grasp the intended meaning, leading to potential inaccuracies in the extracted information.

How to Overcome These Challenges

To overcome these challenges, organizations need to:

1. Invest in robust NLP models that are trained on diverse datasets.

2. Continuously update NLP models to account for evolving regulatory requirements.

3. Incorporate human oversight and review into the reporting process.

Using NLP for accurate regulatory reporting can significantly enhance the efficiency and effectiveness of compliance processes. By automating report generation and validation, organizations can reduce errors, improve data integrity, and ensure compliance with accounting standards. However, it is crucial to address challenges such as diverse language patterns and accurate context interpretation to maximize the benefits of NLP in regulatory reporting.