Artificial intelligence (AI) is significantly enhancing cross-border compliance and transparency in decision-making. By leveraging AI, organizations can:

● Facilitate AI-Driven KYC Processes

● Ensure Transparent Decision-Making

AI-powered tools streamline compliance by automating Know Your Customer (KYC), Know Your Business (KYB), Anti Money Laundry (AML) processes, handling diverse and large datasets to verify identities efficiently across borders. Additionally, the use of Explainable AI ensures that decision-making processes are transparent, providing clear and understandable justifications for compliance-related actions. This leads to more reliable compliance management, improved regulatory adherence, and increased trust in AI-driven decisions, helping organizations navigate complex global regulatory environments effectively.

We are exploring additional transformative ways AI is revolutionizing legal compliance and due diligence processes, highlighting the advantages and addressing the challenges these advancements bring. As introduced in the previous parts of the series, we continue to delve into specific use cases where AI is making a significant impact, highlighting:

- How AI can bring substantial benefits.

- The unique challenges that need to be addressed.

Let’s dive into the fourth part of our series!

7. Facilitating Cross-Border Compliance with AI-Driven Know Your Customer (KYC) Processes

AI-driven Know Your Customer (KYC) processes are revolutionizing cross-border compliance by enabling seamless and risk-based customer onboarding. These processes leverage advanced technologies, including facial recognition and behavior analysis to enhance identity verification and perform enhanced due diligence.

Overview of Artificial Intelligence in KYC Procedures

AI is used in KYC procedures to make the customer onboarding process smoother while still meeting regulatory requirements. By utilizing technology to identify and verify customer identities, AI-powered solutions significantly reduce the time and resources needed for KYC checks.

Facial recognition: This technique compares an individual’s facial features with a database of known identities, making it easier and faster to confirm someone’s identity.

Behavior analysis: By looking at patterns in user behavior, such as transaction history and online activity, AI algorithms can spot suspicious activities that may indicate potential financial crimes or non-compliance.

Real-World Example: Benefits of AI-Powered KYC

One real-world example that demonstrates the advantages of using AI for KYC is how financial institutions employ these technologies to uncover and prevent money laundering activities. With traditional manual KYC processes, it can be difficult to identify complex patterns of money laundering across multiple countries.

However, with AI-driven KYC solutions, financial institutions can quickly and accurately analyze large amounts of data to find potential risks. These solutions can immediately flag suspicious activities, allowing organizations to take prompt action to reduce compliance risks.

The benefits of AI-powered KYC go beyond better compliance accuracy. These solutions also improve the user experience by reducing the time needed for onboarding processes. Customers can complete the verification process more quickly and conveniently, leading to higher satisfaction rates.

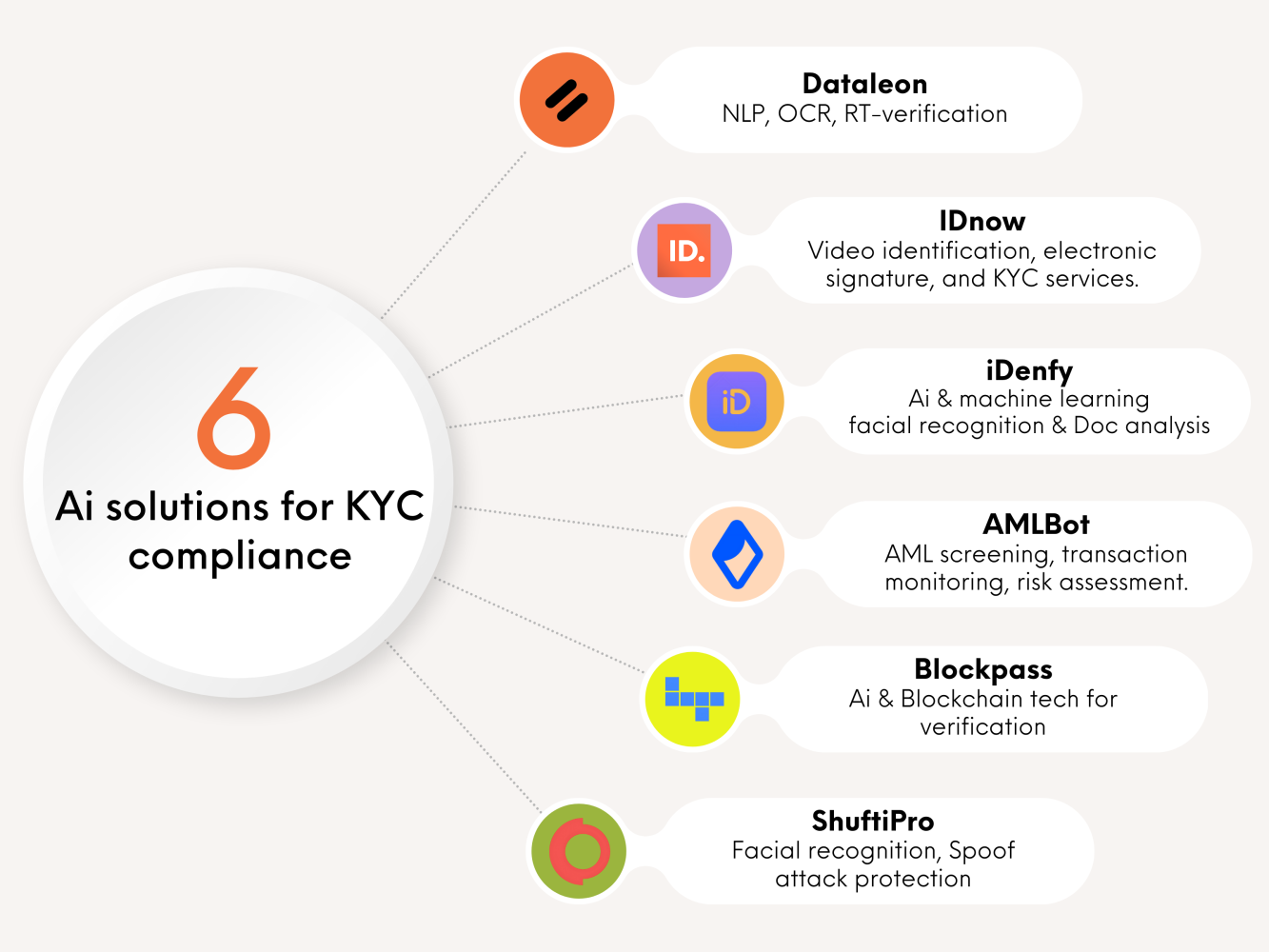

AI-Driven KYC Compliance: Leading Platforms and Their Capabilities

The infographic highlights a selection of AI-assisted KYC/AML/KYB services available today. AI-driven tools significantly enhance efficiency, accuracy, and security in compliance processes.

Dataleon enhances compliance operations with advanced document sorting, KYC ID verification, and KYB business verification.

IDnow offers robust solutions such as video identification, electronic signatures, and comprehensive KYC services to bolster regulatory compliance.

iDenfy excels in real-time identity verification, biometric authentication, and document verification, enhancing security and operational efficiency.

AMLBot integrates critical features like AML screening, transaction monitoring, and risk assessment, ensuring thorough compliance checks.

Blockpass combines AI and blockchain technology to provide secure and efficient identity verification solutions.

ShuftiPro strengthens KYC compliance with advanced facial recognition and spoof attack protection capabilities.

In addition to these tools, several other platforms provide AI-assisted KYC/AML/KYB services:

NameScan offers comprehensive AML/CTF services, including sanctions and PEP screening, leveraging AI for continuous monitoring.

Seon provides fraud detection, KYC and KYB checks, and transaction monitoring with AI-driven real-time risk scoring and behavioral analytics.

Veriff uses AI-powered face recognition and document verification to ensure robust identity verification and AML compliance.

Onfido utilizes AI and machine learning for facial recognition and fraud detection, facilitating secure identity verification and document checks.

4Stop delivers real-time KYC, KYB, and AML compliance solutions with dynamic risk management and global data aggregation powered by AI.

These platforms illustrate how AI is transforming KYC/AML/KYB processes, making them more effective and streamlined. For more details on automated identity verification using AI, refer to the comprehensive overview available here.

Challenges in AI-Driven KYC

While there are significant benefits to using AI in KYC processes, there are also challenges that organizations need to overcome:

Privacy and data protection: AI algorithms require access to a lot of customer data to accurately verify identities and analyze behavior. Organizations must have strong security measures in place to protect this data and comply with privacy regulations.

Algorithm fairness: AI algorithms are trained using historical data, which may contain biases or inaccuracies. Organizations must carefully monitor and evaluate these algorithms to ensure they don’t result in unfair practices or decisions.

Adaptability and Scalability: Integrating Generative AI into KYC workflows introduces the need for adaptable and scalable solutions. Organizations must ensure that their AI systems can efficiently handle varying data volumes and complexities.

Regulatory Compliance: Keeping up with evolving regulations is crucial. AI solutions must dynamically adapt to regulatory changes to ensure continuous compliance in KYC processes.

More detailed insights can be found here.

AI in KYC: As AI technology continues to evolve, its role in transforming KYC workflows will be pivotal in ensuring secure, efficient, and compliant identity verification systems.

Conclusion

AI-driven KYC processes are changing the game for cross-border compliance by making customer onboarding smoother and improving compliance accuracy. Techniques like facial recognition and behavior analysis make it easier to verify identities and spot suspicious activities.

Real-world examples show how AI-powered KYC can be effective in preventing financial crimes like money laundering. However, organizations must also address concerns about privacy and ensure that their AI algorithms for identity verification are fair and unbiased.

8. The Role of Explainable AI in Ensuring Transparent Decision-Making for Compliance Tasks

Explainable AI, also known as XAI, plays a crucial role in building trust and meeting regulatory requirements within the context of legal compliance and risk management. Organizations increasingly rely on AI models for various compliance tasks, such as credit scoring and risk assessment, making it essential to ensure transparency and interpretability in decision-making processes.

Importance of Explainability

Trust and Regulatory Compliance

Explainable AI is vital for ensuring that the decisions made by AI models are understandable and justifiable. This is particularly important in regulated industries where transparency and accountability are paramount.

Use Cases

Real-world examples of explainable AI in credit scoring can showcase how model outputs are interpreted, providing insights into the factors influencing credit decisions.

Approaches to Achieving Explainable Outcomes

Rule-Based Post-Hoc Explanations

Organizations can implement rule-based systems that provide explanations after a decision has been made, shedding light on the factors that influenced the outcome.

Interpretable Feature Representations

By using techniques such as feature importance analysis, organizations can gain a better understanding of the impact of different variables on the AI model’s predictions.

Benefits of Explainable AI

Understanding Model Outputs

Explainable AI enables stakeholders to comprehend the rationale behind AI-driven decisions, fostering confidence in the overall process.

Reduced Bias and Discrimination Risks

Transparent decision-making helps identify and mitigate biases, promoting fairness and equity in compliance tasks.

Challenges

Balancing Explainability with Predictive Performance

One of the key challenges is to maintain high predictive accuracy while ensuring that AI models remain interpretable. Striking the right balance between these aspects is essential for successful implementation.

By incorporating explainable AI into compliance tasks, organizations can not only meet regulatory expectations but also enhance trust and accountability in their use of AI technologies.